Industrial Distribution’s Survey of Distribution Operations is now in its eighth decade, and for all that changes with each iteration, so much also remains the same.

This year, we deployed our comprehensive questionnaire in late March, so our responses will reflect a very unique context: the economy was plummeting at a shocking rate, and many respondents were likely still digesting the impacts to both their lives and businesses.

So this consideration must be acknowledged, and the results may reflect some shaken confidence, whether temporary or otherwise. Despite this, the business environment leading up to COVID-19 was very truly a mixed bag for many companies, so as we attempt to extrapolate trends, we realize that the experience for industrial distributors in this fragmented and highly unique market is a specialized one, this and every year.

As always, the coming pages will examine seven main categories:

- Demographics — establishes a profile of survey respondents based on company size, years in business, sales volume and product line

- Challenges, Trends & Economy — outlines the initiatives distributors are undertaking to address key business and market concerns, as well as mergers and acquisitions and how distributors view the impact of the economy

- Tech Usage & Investments — covers areas like e-commerce and other big-impact technology solutions for now and the future

- The Balance Sheet — offers insights into revenues and profitability, addressing areas of investment, concern and other analysis of factors impacting revenue

- Best Practices — sheds light on distributor relationships with suppliers and customers, as well as their global business plans and what challenges are involved

- Value of the Distributor — addresses the reasons our survey respondents believe customers do business with them, and which service offerings play a significant role in the industry

- Employment — identifies hiring and layoff trends, recruitment and compensation

Here in Part 1, we'll cover Demographics; Challenges, Trends & Economy; and Tech Usage & Investments. Check out Part 2 here.

Demographics

Each year, we see subtle changes in the demographic data of our readership, as businesses further align their strategies with overarching market trends. In line with this, we continue to see industrial distributors expand their reach into new product lines, as they seek to establish their businesses as “one-stop shops.” And while MRO supplies always takes top billing amongst the distributors within this marketplace, other associated categories (safety, tools) are represented in nearly as many distributors.

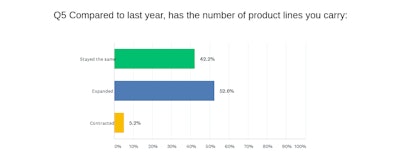

Likewise, 53 percent of survey respondents said that the number of product categories they carry has expanded within the last year — a figure that’s been consistently above 50 percent over the past ten years, though has been as high as 69 percent. The number of companies adding product lines also appears to increase in lockstep with heavy periods of consolidation, as distributors establish product extensions through acquisition.

We’ll dig deeper into the primary concerns within our next segment, but the variety of product lines these distributors sell should provide some cushion as certain industries take a beating throughout this recent downturn. It appears that diversification strategies extend to the industries where our survey respondents keep a customer base, with many markets well represented. Outside of manufacturing/processing, where 83 percent of respondents sell product, readers’ interests extended well into diverse end markets like construction, mining, energy, government and more.

Additionally:

- In the last 15 years, the number of distributors responding to our survey that identify as “family-owned” has dropped by about nine percentage points — from 78 percent to 69 percent today. We expect continued heavy consolidation rates to further whittle down the size of this group over time.

- The number of distributors that have been in business 50 years or more has decreased incrementally over the last decade. In 2011, just over 50 percent of survey respondents had been in business for five decades or more, compared to 45 percent today. That same year, 17 percent of industrial distributors who responded were less than 25 years old, and that group sits at 21 percent today.

- The Midwest and Northeast still represent the areas with the heaviest concentration of industrial distributors, with 30 percent and 20 percent hailing from those areas, respectively. West coast distributors comprise 19 percent of our respondents.

Challenges, Trends & The Economy

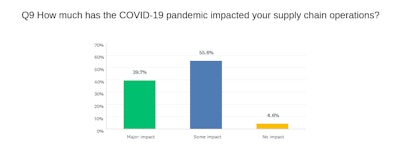

We knew this year’s survey would be different, given the impacts of the COVID-19 pandemic throughout the industrial supply sector. And while the virus caused major fluctuations in some end markets almost weekly, we felt it prudent to ask our distributor respondents how much this landmark disruptor has had on their supply chain operations. Forty percent of them said COVID-19 has had a major impact and 56 percent said it’s impacted them some, while less than 5 percent said they’ve had no supply chain impact.

Branching off of that, we asked distributors to rate their level of business disaster preparedness, which could cover everything from natural disasters hurricanes and tornadoes to pandemics. Only 13 percent rated themselves as excellent in this area, while almost half (48 percent) picked “good.” Another 29 percent rated their preparedness as fair, while 10 percent picked poor.

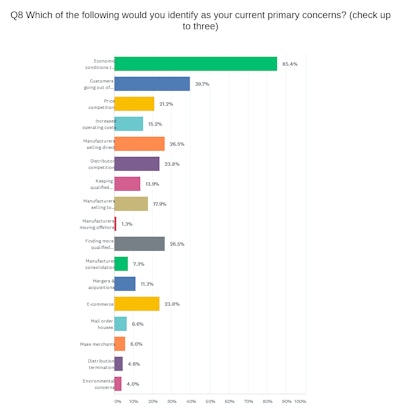

Even when the economy is churning along well, “economic conditions” is always picked as one of our respondents’ top three primary concerns. For example, in our 2017 and 2018 surveys — when distributors were freshly benefiting from major business tax breaks — 31 and 39 percent of our respondents chose economic conditions amid their top three concerns, respectively. That figure increased to 44 percent last year, but 2020 is on an entirely different level. Eighty five percent of this year’s respondents said the economy was a top concern. That’s far higher even than the 58 who picked it in 2011, when distributors were still recovering from the Great Recession.

Relatedly this year, “customers going out of business” was respondents’ next most popular concern, chosen by 40 percent of respondents. “Manufacturers selling direct” and “Finding more qualified people” were the next highest at 26 percent apiece, followed by “E-commerce” and “Distributor competition” each at 24 percent. “Price competition,” which was the most-picked concern for the past three years, including 53 percent in 2019, fell to seventh at 21 percent. Understandably, the vast majority of write-in responses for additional concerns involved impacts from COVID-19.

At 74 percent, growing sales among existing customers was respondents’ top pick as their primary growth strategy, with “Add to customer base” close behind at 68 percent. Those two choices were by far the frontrunners, with “Taking market share from specific competitors” next at 35 percent, followed by “Internet sales” (33 percent) and “Focus on growing industries” (31 percent) as the next two. Compared to other industries, B2B distributors are notoriously slow when it comes to technology adoption, and this was again evident by only 15 percent of our respondents choosing “Invest in technology” as one of their top three growth strategies.

Some other notable stats from this section:

- A quarter of our respondents said their company was approached for a merger or acquisition in the past 12 months, on par with with recent years’ surveys. Five percent said their company was acquired/merged.

- One-third of our respondents said they would be agreeable to a buy-out, up a few percentage points from a year ago.

- Less than 31 percent of respondents said they are actively looking to purchase another distributor, a considerable drop from 42 percent a year ago — reflective of many major distributor and supplier earnings reports that discussed drastic cuts in capital spending to whether the COVID-19 storm.

Tech Usage & Investments

The use of technology in distribution has been expanding over time, as companies begin to see a broader range of solutions available at a variety of price points. Perhaps the most significant of any tech trend reaching this market is that of e-commerce, where online capabilities are becoming more of a basic expectation from customers.

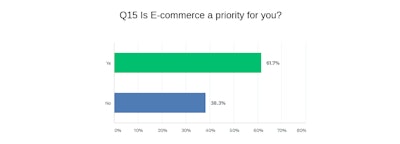

This year, 62 percent of our survey respondents said that e-commerce is a priority for them, which is a jump of ten points in the last decade. Other data points support the suggestion that distributors are coming around on the importance of the web. While not all are using their websites for transactional purposes, many are spending more time and money on their upkeep, whether as a marketing tool, to generate leads or to house technical information. Thirty-seven percent said they update their websites on a daily or weekly basis and 45 percent have re-designed their websites within the past year.

While there are still 40 percent of respondents who say they don’t generate any revenue via their website, the share of business seems to be growing among those who do. Take for example the group of distributors who generate more than 20 percent of sales via the web: In 2018, that was 8 percent of respondents, whereas this year it’s 15 percent.

Additionally:

- 37 percent of respondents say they have a mobile app for their website, which is up five percentage points from what was reported in our 2018 survey.

- Despite the lumpy economic situation, only three percent said they expected their web sales to decrease in the coming year. The majority (66 percent) believe it will increase, while 31 percent said they expect it to remain consistent.

- The technologies most heavily used by our readers are wireless email/internet access (76%); CRM (55%); online web ordering (51%) and ERP (33%). Of the technologies in use, 30 percent cited CRM as being the most impactful.

- Distributors who are eying new technology solutions are most likely to implement CRM, e-commerce and sales force automation tools.

Methodology

Results of this study are based on an email survey sent to Industrial Distribution subscribers. Recipients of this survey were offered an incentive to complete the questionnaire.

Industrial Distribution’s subscriber base is comprised of 27,000 readers, the majority of whom identify as upper management (executive level managers or company owners). The remainder of the subscriber base identifies as sales or sales management. Results are based on a pool of respondents within this subscriber base.