Are companies offering COVID-19 pay protection in 2021? (Less so than in 2020.) Is seller non-compensated revenue increasing? (Yes.) How much do companies spend on contests and spiffs? (3 percent of W-2.)

The Alexander Group examined these and other questions in the 2021 Sales Compensation Hot Topics Survey published in July. More than 120 sales departments provided their perspectives on 37 questions. The topics included 2021 midyear assessment of practices, wage inflation, COVID-19 implications, sales crediting, and contests and spiffs.

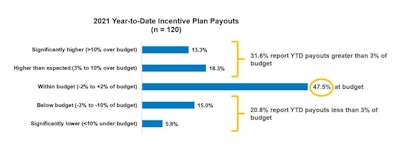

Midyear Practices

At the start of the fiscal year, revenue leaders expected a revenue rebound in 2021. However, year-to-date performance has been stronger than initial projections. 31.6 percent of the participants are exceeding their incentive budget by greater than 3 percent. Some companies are making midyear quota adjustments.

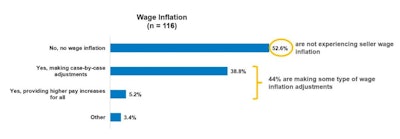

Wage Inflation

Wage inflation is becoming more apparent as most companies seek to match or exceed market rates. 44 percent are making some type of wage inflation adjustment.

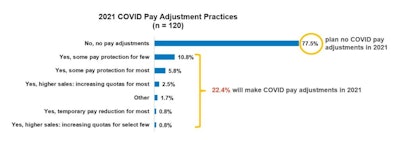

COVID-19 Practices

Many companies offered some degree of pay protection in 2020 if earnings were significantly impacted by COVID-19 restrictions. Fewer companies see the need for such protective practices in 2021. 22.4 percent are making adjustments in 2021, down from 60.6 percent in 2020.

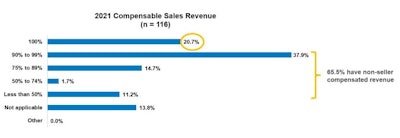

Sales Crediting

The use of “other” non-compensable sales channels (e.g., e-commerce) is increasing. 65.5 percent have non-seller compensated revenue.

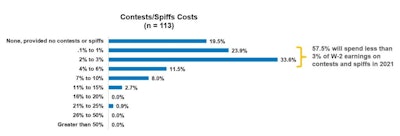

Contests and Spiffs

Most companies will spend less than 3 percent of W-2 total population earnings on contests and spiffs.

Key Findings Summary Observations

2021 midyear sales compensation payouts are trending higher than expected. Wage inflation is increasing. The need for COVID-19 pay protection in 2021 is still evident, but less so than 2020. Non-compensated revenue is increasing. Finally, expect to spend 3 percent or less of W-2 earnings on contests and spiffs.

Learn more about Alexander Group’s sales compensation practice or download the executive summary to discover more tactical information on these findings.

David Cichelli is a revenue growth advisor for the Alexander Group. Connect with him on LinkedIn.