In May of this year, Rexel USA announced the acquisition of Talley Inc., a Los Angeles-based distributor of wireless infrastructure products, services and solutions with 11 warehouses and over 300 employees.

At the time, the company commented on the acquisition as representing “a significant milestone” in support of its “mission to accelerate electrification and deliver innovative, sustainable energy solutions.”

And accelerate it has — largely because, according to Rexel USA CEO Roger Little, the firm’s customer base is “asking for help.”

Little recently told Industrial Distribution that many companies in North America are finding that they need expert assistance in realizing sustainability goals — and they’re looking to suppliers like Rexel to bring knowledge and integrated solutions to the table.

According to Little, these are objectives that many organizations have not had in the past, and companies like Rexel are well-positioned to respond.

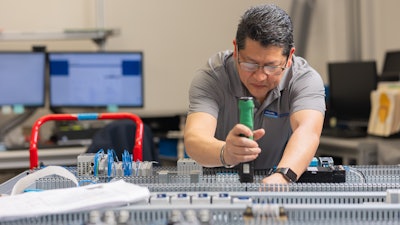

Outside of its thousands of supplier brands dedicated to energy solutions – even a “sustainable selection” module on its website – Rexel USA supports its transactional sales with a more integrated approach. The company says nearly half of its employees are dedicated to taking the products it sells and crafting a tailored solution for customers. This is embodied in supply chain models that are designed to reduce inventory, cut installation costs and improve productivity. Energy teams also work to identify energy-saving opportunities — from upgrades and retrofits all the way to complete energy management solutions.

A More Complete Solution

And it’s the complete solutions that customers are clamoring for, according to Little — even more so post-pandemic.

“Saving energy has always been a good idea, but now, there’s an increased focus on electrification and we have had many of our largest customers come to us and ask for help,” said Little. “We do have several parts of our business that can assist them with that, whether it be installation of electric vehicle chargers for a fleet, rooftop PV and the associated inverters and racking, and the balance of the system that goes with PV ... So there’s quite a few pieces to that. I think there’s a lot of people with a desire, or at least a notion, of where they want to go, but not necessarily knowing all the pieces and all the systems they require to get there.”

According to Little, the U.S. distribution market is still fragmented compared to most markets globally, which allows for “huge opportunities” for companies of “good scale” — a characterization Little believes applies to Rexel. Acquisition targets comprise “a combination of core and adjacencies for us: Core being good old-fashioned electrical distribution, what we do every day, and adjacencies being services and other products that we see very close to the electrical space.

“An example of that is Datacom and or utility. Our most recent acquisition – Talley Inc., a wireless broadband distributor – is a good example of an adjacency for us. It gets us into a space that’s extremely close to electrical, but not necessarily pure electrical like we’ve traditionally been involved with.”

A Full Breadth in Support of Uptime

Despite this eye for growth, Rexel USA is committed to engaging in the basic blocking and tackling of a day-to-day industrial environment.

“Obviously, uptime is a big focus of our industrial client base,” Little elaborated, “so making sure that we’ve got productivity tools, we’ve got uptime tools, we’ve got cybersecurity tools that can help them with those different areas of their business and make sure we’re offering the best-in-class service to them.”

Then, as post-pandemic workforce challenges came hard and fast for everyone, Rexel was well-positioned: pairing an efficient business model with the entrepreneurial spirit of a smaller enterprise. Little believes that comes from culture and, for Rexel, it means being transparent about the company’s strategy and how individual employees can be a part of it — “really taking the voice of our associates and making sure we’re listening carefully, seeing what’s important to them.”

Little added that the company’s electrification efforts don’t hurt, either. For some, finding a role where they can be involved in a new, exciting energy management trend offers additional value. And every little bit counts in an environment of “constant one upmanship,” where competitors vie for top talent with increasingly better pay and benefits. Little sees employee retention as the no. 1 challenge in the industry right now. The other? The supply chain, which he describes as sometimes “fragile” despite the improvements made over the past two years. Never one to leave a challenge untapped, Little characterizes supply chain improvement as an “opportunity” the company hopes to leverage.

Being ‘Much More’ for the Industry

“We’re not just focused on being an electrical distributor; we’re focused on being much more than that,” Little said. “Our biggest and best clients are asking us to be more than just an electrical distributor for them. They don’t just want a box mover. They want somebody that thinks far beyond that. And I believe we’re best in class at doing it.”