As one of the only large B2B distributors that publicly shares its monthly sales information, Fastenal did so for April Wednesday morning — and the numbers showed staggering impacts from the COVID-19 pandemic.

The vast majority of publicly-traded industrial distributors have reported year-over-year sales declines amid a plummet in demand during the second half of March and throughout April. But at Fastenal, April sales of $491.5 million actually increased 6.7 percent year-over-year. Sequentially, April sales were up 3.9 percent over March and up 14.0 percent from February. March sales likewise were an improvement from February.

Fastenal’s sales gains have come its safety product line, which saw a 31 percent year-over-year (YoY) gain in March and then surged 120 percent in April. That compares with March declines of 10.1 percent for the company’s fasteners line and 2.5 percent decline in ‘Other’, followed April by declines of 22.5 percent in fasteners and 10.1 percent in other.

Lewis

Lewis

Fastenal typically doesn’t host such a conference call with its monthly sales reports, but Lewis noted that the size of the month-to-month sales fluctuations warranted an explanation.

Lewis said that while the company’s manufacturing and construction customers have been severely hobbled by mandated factory shutdowns amid COVID-19 safety measures, other traditional customers in areas like food processing have been actively sourcing PPE from Fastenal. Meanwhile, sales to state and local government and healthcare customers, which typically comprise less than 5 percent of company sales, were close to 10 percent in April and up 184 percent YoY during the month.

Lewis provided the example of one exceptional customer order from a large OEM that engaged with Fastenal’s Industrial Services division for the distributor to assemble 170,000 “back-to-work kits” comprised of masks, sanitizers and temperature gauges. Lewis said hundreds of Fastenal employees came together to complete the project in less than a week, which allowed the customer to bring its employees back.

“Our safety teams were able to pivot to critical needs customers, getting product to over 450 medical, healthcare and hospital customers that had bought little to no product from Fastenal in the past,” Lewis explained. “In fact, the surge orders we experienced in April were a product of more than 11,000 accounts that had not bought safety products from Fastenal in 2019.”

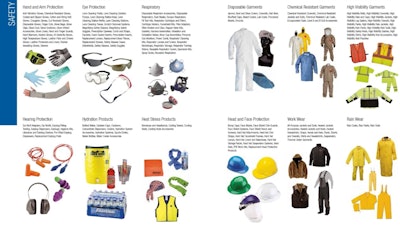

The safety section of Fastenal's current product catalog.Fastenal

The safety section of Fastenal's current product catalog.Fastenal

As far as underlying business activity, Lewis said the expectation is that May will improve from April as the US economy begins to reopen, though to what extent is not clear and Fastenal certainly doesn’t not expect a return to anywhere near the pre-COVID levels. And while the company’s safety surge orders in May might not be quite at the level of April, they should remain meaningful in the period.

From a supply chain standpoint, Lewis shared that a lot of the April safety product was sourced and moved outside of Fastenal’s typical channels, which weighed on its gross margin. Additionally, much of the product was shipped direct and in bulk, as opposed to on the company’s trucks and through its network, which means Fastenal expects freight revenues to have worsened with its core customers and for there to be a less efficient utilization of the company’s trucking fleet.

“The current environment continues to pressure profitability, however, the magnitude of impact to operating margins in second quarter of 2020 may not be as great as originally anticipated,” Lewis said.

Other notable stats from Fastenal’s April:

- Sales to manufacturing customers fell 15.6 percent YoY, while sales to non-residential construction fell 15.5 percent. Those figures compare to growth of 7.4 percent and 8.3 percent, respectively, a year earlier.

- Daily sales to national accounts grew 16 percent YoY, while daily sales to non-national accounts declined 6 percent. Those figures compare to growth of 12.0 percent and 1.0 percent, respectively, a year earlier.

- 22.0 percent of Fastenal’s top 100 national accounts grew sales in April, compared to 70.0 percent a year earlier

- 34.1 percent of Fastenal’s public branches grew sales in April, compared to 59.7 percent a year earlier

- Fastenal’s absolute headcount ended April at 21,587, down 2.5 percent from March and down 3.2 percent YoY. Fastenal ended April with a total selling personnel count of 13,417, down 5.5 percent from March and down 6.1 percent YoY. Fastenal ended April with 2,961 distribution personnel, down 13.0 percent from March and down 12.1 percent YoY.