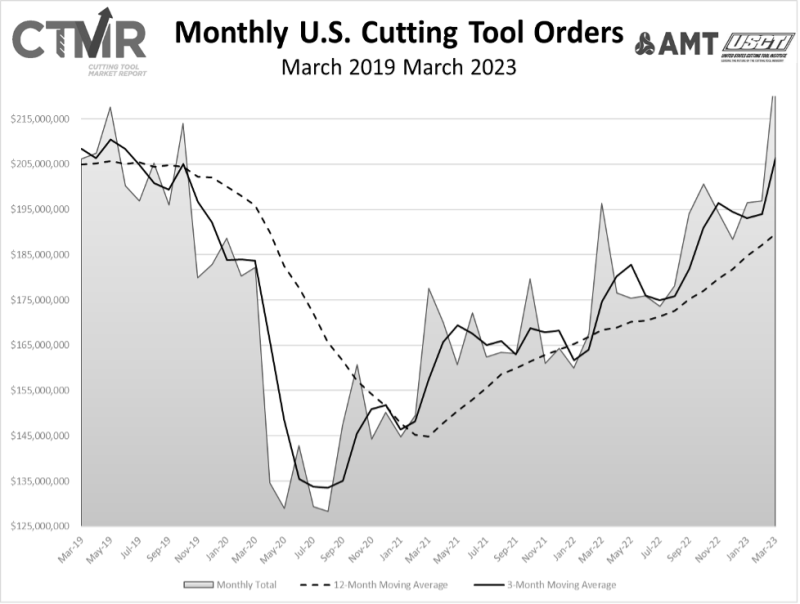

McLEAN, Va.– March 2023 U.S. cutting tool consumption totaled $225.6 million, according to the U.S. Cutting Tool Institute and AMT-The Association For Manufacturing Technology.

This total, as reported by companies participating in the Cutting Tool Market Report collaboration, was up 14.6% from February’s $196.9 million and up 14.9% when compared with the $196.4 million reported for March 2022. With a year-to-date total of $618.9 million, 2023 is up 18.1% when compared to the same time period in 2022.

These numbers and all data in this report are based on the totals reported by the companies participating in the CTMR program. The totals here represent the majority of the U.S. market for cutting tools.

“While the March data was impressive and most shops remain busy, early indications are showing that Q2 will not continue to perform at this level,” said Jack Burley, chairman of AMT’s Cutting Tool Product Group and Committee. “The anticipated reduction in demand we thought would not happen until Q3 appears to be sooner than expected. On a positive note, it was good for cutting tool producers to have a great first quarter to build upon.”

Chris Chidzik, principal economist at AMT, continued that positive note, saying, “Cutting tool sales in March 2023 were astronomical, contributing to the best first quarter since 2019. Machinery orders have surged in the past two years, but sales of cutting tools had struggled to return to pre-COVID levels. The March 2023 numbers show that machines are starting to hit shop floors, demand for parts remains strong, and materials are available to make them.”

The Cutting Tool Market Report is jointly compiled by AMT and USCTI, two trade associations representing the development, production, and distribution of cutting tool technology and products. It provides a monthly statement on U.S. manufacturers’ consumption of the primary consumable in the manufacturing process – the cutting tool. Analysis of cutting tool consumption is a leading indicator of both upturns and downturns in U.S. manufacturing activity, as it is a true measure of actual production levels.

Historical data for the Cutting Tool Market Report is available dating back to January 2012. This collaboration of AMT and USCTI is the first step in the two associations working together to promote and support U.S.-based manufacturers of cutting tool technology.

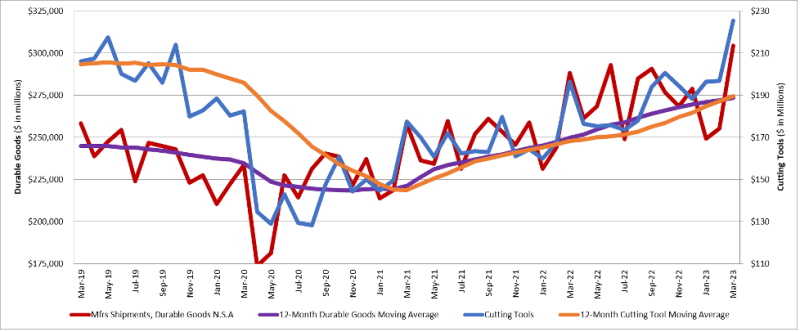

The graph below includes the 12-month moving average for the durable goods shipments and cutting tool orders. These values are calculated by taking the average of the most recent 12 months and plotting them over time.