During the first half of 2022, we met several company representatives at conferences, visited offices and talked to leaders and executives of distribution companies. The conversations invariably turned to how rapidly they were experiencing change.

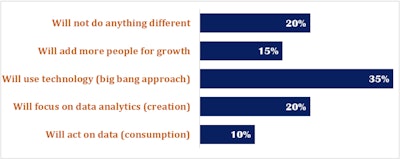

Through these interactions, we discovered five different responses and types of wholesaler-distributors in the current business environment.

20% are not doing anything different

The companies that primarily make up this space are industrial, chemical and jan-san verticals, and they are still in a reactive firefighting mode. They are leveraging price increases and gaining additional margins, witnessing 15%-30% revenue growth. That growth roughly breaks down into 5% organic growth and 95% growth due to pricing inflation, meaning that if the frequency of vendor price increases drops, these companies’ revenue will decline.

The pricing teams or individuals at these companies have been busy tackling price increases and managing price matrices. The sales team and purchasing teams are scrambling to get products. Unfortunately, companies in this group are not leveraging data to the fullest potential. Decisions are still subjective and market-driven.

15% are adding more people for growth

The next set of companies lacks process efficiency. Instead, they add more people to their teams to combat market and supplier challenges. When a process is absent, people become your process. Distributors in this bucket typically hire in two key areas: inside sales and purchasing. The inside sales team works in tandem with the outside sales and makes outbound calls to smaller volume customers. Distributors expand purchasing teams to help find products by working with multiple vendors.

35% are using new technology (big bang approach)

Many distributors fall in this category. They are implementing new ERP systems, CRM, pricing tools and other technology solutions. However, these companies typically do so without clearly defining business processes and assessing what they need instead of what they get from the new system. These companies fight through chaotic starts, learning things the hard way. Companies in this group are looking for quick big wins.

20% are focusing on data analytics (primarily data creation)

The distributors on the path to leveraging data spend most of their resources on analytics creation, using data to create several reports and dashboards. However, they place less emphasis on the outcome of the analytics itself. In this instance, they fail to address three critical questions:

- What are the specific business needs that require data-driven insights?

- Where will data be used (purchasing, sales, etc.)?

- Who are the users of all the reports and dashboards?

These companies spend 80% of the time creating all the reports, and 20% focused on making day-to-day decision-making easy for the users.

10% are acting on data (primarily data consumption)

There are relatively few companies that focus efforts on using the output of analytics to make decisions and improve the bottom line. These companies begin by answering three questions:

- How will analytics create measurable value?

- What capabilities must be in place?

- How do we enable and implement it?

The Takeaway for Distributors?

The distributors that use data for decision-making spend 80% of the time creating reports and dashboards and only 20% of the time using the information. To move into the fifth category, acting on data, companies need to answer two critical questions:

- What are we trying to use the data for (specific, actionable use cases)?

- Who are the users, and how do data-driven insights fit into their workflows?

By answering these questions and using them to inform their data consumption, most companies will successfully apply analytics to make more profitable decisions.

Pradip Krishnadevarajan is the co-founder and managing director of ActVantage.