Since its launch in 2015, Amazon Business has eaten up billions in market share and wounded traditional distributors. It will do even more damage over the next few years if distributors fail to adapt. In order to do that, however, distributors must understand why Amazon is succeeding in the first place.

Amazon uses 3 AI-based strategies to win: product recommendations, enhanced search, and targeted advertising. My most recent whitepaper explains exactly how these strategies work and what distributors can do to replicate or advance them within the B2B world. In this article, I’ll offer a quick summary of those points to give busy distributors quick insight into how these tools account for around $80 billion of Amazon’s sales.

Strategy 1: Product Recommendations

Amazon’s number one sales strategy is product recommendations. You will likely recognize these as features like “recommended for you,” “products you might like,” or “customers also bought.”

Most online shoppers have grown accustomed to such features by now. But if you think about what Amazon is really doing with these, it’s actually quite amazing. The company is using AI to process data and predict exactly what each customer is likely to buy, then it’s finding clever ways to sneak these recommendations into your shopping experience.

In effect, AI allows Amazon to turn a passive online store into an active sales environment. This does wonders when it comes to customer engagement and total sales. Specifically, Amazon’s AI features help to decrease the bounce rate by 10-15% and increase customer engagement by more than 40%.

As customers move through Amazon’s website, AI-powered recommendations keep customers engaged and spending. At the end of the day, these suggestive selling features end up accounting for 35% of customer purchases. Based on Amazon’s massive sales volume, this means that these features are worth about $50 billion.

Strategy 2: Search Relevancy

Product recommendations are Amazon’s way of creating sales before the customer even knows what they want to buy. But what about when a customer does know? What about when a customer searches for a specific item?

When a customer uses Amazon’s search bar, they end up clicking through to a product 42% of the time. In contrast, shoppers that search for products on Walmart only click through to potential purchases 16% of the time. Etsy and Best Buy fare even worse. Their customer searches only end in clicks 13% and 12% of the time, respectively.

In theory, it should be easy to show customers the products they want when they explicitly ask for them. In practice, this is clearly not the case.

So why is Amazon so good at search? Well, it turns out that Amazon has more than 800 engineers with expertise in search relevance. These AI-savvy technicians spend all day figuring out how to understand the meaning of customer searches with natural language processing, how to assess the relevance of possible results with statistical analysis, and how to understand the context of searches based on web activity.

All of that work pays off handsomely, as Amazon is able to use AI to convert 3x more searches into sales than their competitors. Based on Amazon sales volume, this means that the company makes an additional $800 million a month, or roughly $10 billion a year, with its AI-enhanced search features.

Strategy 3: AI-Based Advertising

Amazon’s accurate recommendations and high-functioning search allow the company to pair the right products with the right buyers. This has obviously endeared the site to customers, as some 89% of buyers report being more likely to buy products from Amazon than any other platform. However, what often gets overlooked is how attractive this makes Amazon to advertisers.

Amazon has the two main things advertisers look for. One, a large and loyal audience of buyers for advertisers to target. And two, it is excellent at playing the role of matchmaker, using its AI to route advertisements to the right customers.

Advertisers promote their products through Amazon on a pay-per-click basis. It’s a win for advertisers, who know that their products are only being shown to browsers with a high likelihood of buying, and it’s a huge win for Amazon because the company gets to double-dip on sales. Not only does Amazon sell billions of dollars of products, it gets paid billions of dollars to make those sales!

This lucrative advertising business has been growing fast. Heading into 2020, Amazon is on pace to rack up $20 billion in “other” revenue, a category mostly composed of advertising income. This means that Amazon’s AI-recommendations and enhanced search don’t just create roughly $60 billion in sales, they also create the opportunity for $20 billion more via AI-targeted advertisements.

How Can Can Distributors Respond?

In order to compete with Amazon, distributors will need to deploy AI-powered strategies of their own. In some cases, these may look similar to Amazon’s. But in others, distributors will be better served by infusing AI into pre-established, distribution-specific features. For example, distributors might seek ways to empower traveling sales reps with AI-recommendations and data-dictated schedules.

Our whitepaper offers a complete explanation of Amazon’s strategies discussed above and a thorough discussion of how distributors can build profitable AI-tactics of their own. Learn more here: https://welcome.proton.ai/amazon-white-paper.

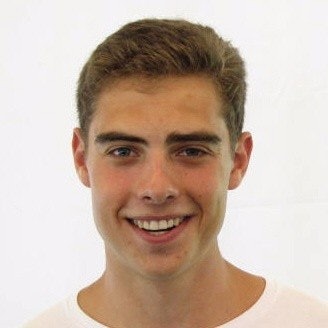

Cohen

Cohen

Benj Cohen founded Proton.ai to help distributors harness cutting-edge artificial intelligence and dominate the digital age. He learned about distribution firsthand at Benco Dental, a business started by his great grandfather. While Benj was studying Applied Math and Data Science at Harvard University, he saw an opportunity to apply innovative technology to distribution, enabling distributors to sell more in modern markets