As millions are poured into B2B E-Commerce, the North American B2B customer will purchase in the neighborhood of $1 trillion dollars online within the year. This is somewhere between 12 percent to 15 percent of all B2B demand and grows at 8 percent per year. If the growth rate holds, nearly a quarter of total demand will be online by 2025 and a third by 2028.

Our work and research, however, finds that online growth, in the mostly mature B2B markets is anything but evenly "spread out" among the existing firms who serve the B2B economy. For mature firms, our work and research, since 2013, finds that 20 percent of existing firms get 80 percent of the online sales. This means, for every 10 competitor firms, 2 are participating in a growth market with a 3.5X greater CAGR than the US GDP. Looking at this another way, 8 businesses have to play catch up and our research shows, over the past five years, they've mostly failed to do so; the top 20 percent of online firms five years ago are, more than likely, still on top today.

Our concern is, mainly, with mature, established businesses, both distributors and manufacturers. We are consultants and have, for 20 years, helped mature B2B businesses to market; without them there is no business. It is important to note that distributors have the biggest exposure here as their basic services are, to date, easily replicated, and often improved upon by net new online competitors. Manufacturers also have exposure but their value added is product technology which is not easily replicated unless the products are commodities and they've been milked for a long time. Additionally, manufacturers can more easily secure new paths to market that are good in online technology.

Adding a new dimension to the online puzzle are net new online business entities, in the B2B sector, who don't have the growth problems, cultural issues and online biases of their "analog" competitors. A 2017 study from McKinsey & Co., published in the MIT Sloan Management Review found that made for online entrants comprised only 17 percent of firms but held 47 percent of global online revenues. This means that the rest, 53 percent, is 80 percent taken by 20 percent of existing, established businesses. Taking the math a bit further, there is roughly 11 percent of B2B online sales served by 80 percent of the existing, mature, B2B firms and their hold on this small slice of the online pie is tenuous. An increasing body of research out of the distribution sector finds that firms that have 25 percent or more of sales online are most often in the top 20 percent (with 80 percent of sales in their sectors) and appear to be growing their lead at the expense of the remaining 80 percent of traditional competitors.

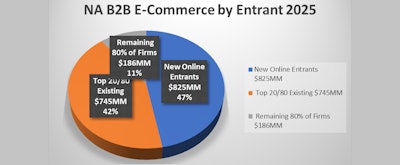

Looking at this problem another way is to think of a pie that, by 2025, will be in the neighborhood of $1.75 trillion dollars in B2B online sales. The breakout, if current trends hold will resemble the slide "NA B2B E-Commerce by Entrant 2025."

In the slide, the market of B2B E-Commerce in 2025 will have 47 percent of demand going to net new online entrants for a value of $825 billion in USD sales. Forty-two percent (42 percent) will go to the top 20 percent of mature "analog" firms representing 80 percent of the online sales not going to new entrants for $745 billion in USD sales, and the remainder or 11 percent of total online sales going to 80 percent of the remaining "analog" firms or $186 billion in sales.

The message to existing "analog" firms not in the top 20 percent of today's online firms is clear. If you don't get better, and soon, you will lose out on not only a growth market but the undeniable trend toward digital commerce where ONE THIRD OF ALL B2B VOLUME WILL BE ONLINE IN A DECADE.

This change is glacial and tectonic; slow but with large implications. As such, not everyone sees this when the market is 1/6th. to 1/7th built out today. But the body of research and documentation are clear, leading firms in e-commerce today have a very good chance of dominating in a digital future. The 80 percent of "analog" firms and their slow start in digital commerce should consider six immutable laws that successful firms continue to work through for online success.

The Immutable Laws of B2B E-Commerce Success

Law I: E-Commerce is more than a transaction

E-Commerce goes well beyond the ability of the customer to complete a transaction online. This is a goal of the technology but it is not the "spirit" of what the technology can and will do for the customer. E-Commerce allows the customer easier access to products and services you sell, it is more convenient. Firms that try and hold on to all of the existing "analog" capabilities of full-service sales, full complement of CSR's, and other systems to "take care of the customer" are missing the point. E-Commerce allows greater convenience and higher quality of service while reducing the cost to serve. If executives aren't planning to pare back redundant costs, they add cost to the channel, and price themselves out of the market.

Law II: E-Commerce is not just about the tech

Too many "analog" firms, when building out their technology, become focused on the tech and lose sight of the customer. The latest online bells and whistles are great as online technology improves every day. However, firms can burn through millions and have little to show for the technology investment. If executives aren't migrating existing accounts online, while leaning out the redundant service capacity, and making changes to the "analog" culture to nurture online progress, technological wizardry will have a disappointing ROI.

Law III: E-Commerce means big changes to the business

Successful e-commerce firms make changes to their business to ensure growth of the technology. These changes often include: Changes to the number of sellers and the type of sales roles, reduction in physical locations that store product to ship to market, new operating procedures that support fast, accurate delivery, and department managers who are committed to drive changes down through the organization. Finally, if managers aren't held accountable by the e-suite, they won't voluntarily or enthusiastically make changes for online success.

Law IV: E-Commerce means new competitors and new opportunities

If you have desires to move your firm into the top 20 percent of e-commerce firms, your competitors will be less the 80 percent of "analog" firms who serve 11 percent of the online market but the top firms and new online entrants who make up 89 percent of B2B online sales. This means your marketing and sales should have plans on how to deal with these new competitors including, even, developing new channels and new business models. A good example of a new business model is Grainger's Zoro Tool which started as a new, low-price, entity in 2011 not associated with the corporate parent. Today, Zoro is somewhere around $500 billion in North American sales; not bad for a company started from scratch seven years ago.

Law V: E-Commerce requires nurturing new positions with new goals and new measures

New positions including online product managers, content manager(s), vendor relationship managers, automated marketing managers etc. are common when succeeding in e-commerce. The need for support, funding, and new goals and measures for these positions is real. Simply throwing them in the mix and telling them to figure it out is a sure recipe for their frustration and eventual failure. Existing "analog" cultures are not kind to e-commerce employees and their new processes — they are seen as threats and the dominant culture will undermine new hires and changes to the status quo. Executives should consider actively nurturing e-commerce with their oversight, adequate funding, and clear instructions to the "analog" culture.

Law VI: E-Commerce means culture change

"Analog" cultures are well-established and take change to the status quo seriously and, mostly, badly. We've seen far too many firms simply launch e-commerce with software investment and a few new heads and not much in the way of supporting cultural changes in sales, customer service, marketing and operations. The result, a few years down the line, is that the new hires quit and go to a firm that will support their value. Execs who don't have a change plan in place, as new hires are brought on board, can bet their efforts will have a high probability of failure. And failures of culture are especially noxious; they embolden the dominant culture to undermine additional efforts and the exec's job is made more difficult as new online efforts are undertaken.

Scott Benfield, B2B Supply Chain Consultant

Scott Benfield, B2B Supply Chain ConsultantFirms not in the top 20 percent of online market performance risk a declining market as online commerce grows at 8 percent per year. Today, B2B online commerce is 12 percent to 15 percent or so of all transactions. By 2028, it will represent a third of all transactions and firms not well-established and growing their online efforts will find top line growth in trouble. Success in online commerce is clearly the responsibility of the executive suite and too many executives aren't making bold moves for future success. If your firm is in the B2B sector and has competitive online technology but not growing online, it is likely an executive issue and two or more of the Immutable Laws are being broken.

Scott Benfield is a consultant for B2B manufacturers and distributors. He is President of Benfield Consulting and member of Digital Channel Advisors, a group of consultants dedicated to bringing online success to mature B2B firms. He can be reached at [email protected] or (630) 428-9311.