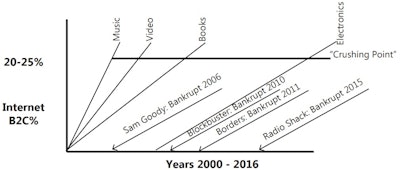

Would your customers continue to order from you if you had no one available to help them? If you didn’t have the products they need? According to retail expert Guru Haraharan, that’s just what happened at some renowned retailers such as Sam Goody, Blockbuster, Borders and Radio Shack. When Internet sellers reached 20-25 percent B2C market share — Hariharan’s “crushing point” — these companies panicked. They felt the need to compete solely on price. They cut staff, training, and customer support — yet profit margins kept falling. First music (Tower Records, Goody), then video, books, and consumer electronics. These leading retailers were bankrupt within about 12 months. Already this year, The Limited, Gander Mountain, Payless ShoeSource, and Gymboree have filed for bankruptcy.

What must distributors learn from what’s happening in retail? We have all heard distribution is being disrupted. Let’s dig deeper into the parallel between retailing and distribution.

Internet sellers (especially those without brick and mortar) have ignited a price war in retailing and wholesaling. The historic pricing truce between retailers and consumers, and among suppliers, distributors, and customers, has been broken. Buying and selling has again become a game of continuous haggling.

Customers want to perceive worth — that they are getting a good value. They used to rely on list prices and discounts. They also love deals. They want to feel they are winning, not losing. In B2B, customers have relied on our field sales reps to protect them. Now, pricing transparency is destroying their perception of worth. Customers are more suspicious they are losing in negotiations. Variable airfares, surge-priced rides, rental car pricing, and soda machines that raise prices in hot weather, for example, broke the truce.

In retailing, the head merchant has always been all-powerful, second only to the CEO. Traditionally in distribution, the sales department has had a strong hold over pricing. The power is slipping out of the hands of head merchants and distributor sales organizations as the “gut feel” method of setting prices has led to non-market pricing and the collapse of profits.

The old one-price system in retailing is falling apart. Customers learned to use their search engines and cell phones to get better deals on TV sets, for example, at Best Buy. Those same shoppers are now using distributors as showrooms to examine the products they want, but ordering elsewhere.

Successful retailers are now gathering data on consumer spending habits. Economists and algorithms are changing prices multiple times per day. Winning wholesalers have learned how to use strategic pricing, customer profitability analysis, and cost to serve data. Pricing experts know buyers can’t track every price. Software programs use game theory to make sure prices are competitive on “eggs and milk” but raise margins on items of lesser importance. Customer price perception is all-important.

Traditional distributor pricing depends on the price book, bracket or column pricing, list less discount, and self-directed sales reps on commission plans. Reps “meet the competition” with prices memorialized in an almost infinite number of special price records in their computers. Many of the powerful features in distributor ERP system pricing libraries are underutilized or not used at all.

The pricing truce in distribution is eroding. The prevalence of rebates, sheltered income, and buying group deals is making pricing more chaotic. Increasing dependence on deviated costs from suppliers for specific customers is invalidating published list prices. The trend toward large supplier growth rebates distorts pricing and compounds the confusion.

Grainger, long admired by other distributors for its large margins, reacted this January with a repricing strategy. In response to weak sales, Grainger cut prices on large contracts, slashed hundreds of thousands of list prices, and lowered Internet prices. In the first quarter alone, Grainger reduced prices by an average of 7 percent on 45 percent of its items. Thus far, through the second quarter, the result has been a large drop in profits.

In retail, Walmart embattled by Amazon, recently lowered prices on one million online-only items by offering a discount of $7 to $50 for customers willing to pick up their purchase at a Walmart store.

In distribution, Amazon is ready to enter the medical supply industry touting its “new features and unique benefits” according to Chris Holt, leader of Global Healthcare. Amazon can leverage downward pricing pressure as well as its track record of reliable service and “a cost structure that kills.” Medical distributors may feel protected by a moat of regulatory hurdles, licensing, and special handling requirements for their products. Amazon appears poised to cross that moat.

There is a shift of channel control to the customer. Pricing is at the center of it. This disruptive shift is a threat to distributors and suppliers. What can distributors do to assure continued success?

- Recognize there are some things gigantic companies can do that smaller businesses can’t. Don’t try to beat the giants at their own game.

- Work more closely with suppliers. Both parties are responsible for making sure customers get the right price.

- Don’t settle for mediocre profits. A pretax return on assets of less than 7 percent, and pretax return on investment under 15 percent, are below average and don’t bode well for your viability.

- Use strategic pricing to elevate overall margins by 100-200 basis (1-2 percentage points). Most distributors can achieve, and sustain, gains of this much or more.

- Use customer profitability analysis to help manage pricing and people productivity. You should be able to improve your Personnel Productivity Ratio by at least 2 percentage points.

- Measure cost to serve. You must segment your customers not only for pricing but also to know how to invest service costs in the right customers.

- Develop a pricing strategy that keeps you competitive and makes profits for your business.

- Redesign your pricing process to be market-driven and optimize the effectiveness of your field sales team.

- Make sure your ERP system supports your pricing strategy and process.

- If you need help, find a consultant who knows pricing and distribution. Guru Haraharan’s firm, Boomerang, provides that service for retailers, as we do for distributors.

Brent Grove, Managing Partner at Evergreen Consulting

Brent Grove, Managing Partner at Evergreen ConsultingThis article was originally posted by STAFDA in its August 2017 Advisory. STAFDA's monthly advisories are available in its members-only section.

Brent Grover, STAFDA’s Profitability Consultant, is a well-known distribution industry advisor, speaker, and writer. He is also a National Association of Wholesalers (NAW) Institute Fellow and has written eight books, including Strategic Pricing for Distributors. Brent founded Evergreen Consulting, LLC in 2001 to advise companies in the distribution channel. For more information, contact him at 216/360-4600 ext. 101 or brent@ evergreenconsulting.com.