Trucking regulations and safety measures have become primary concerns for the modern shipping and logistics industry. The remainder of 2016 will see a resurgence of oversight and regulatory measures through many different rules and requirements. From the Federal Motor Carrier Safety Administration (FMCSA) to the Environmental Protection Agency, shippers need to know how these rules will impact their operations. According to William B. Cassidy and Reynolds Hutchins of JOC.com, shippers will need to pay attention to the following standards and regulatory changes.

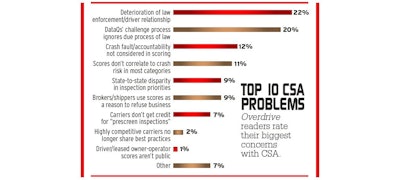

1. Compliance, Safety and Accounting Initiative

The CSA initiative was designed to reduce accidents and risk throughout the industry. However, actual rules of the CSA vary heavily, and parts of the logistics industry are manipulating these rules to gain an unfair competitive advantage. Unfortunately, the FMSCA is set to continue using these rules and expand upon them. As a result, shippers will need to be more vigilant of how every action could impact their overall percentile rating. Although the percentile rating is not a scoring system, it is being treated as such throughout the industry.

2. Hours-Of-Service

The hours of service trucking regulations will continue to be a focal point of the FMCSA in 2016. Drivers will be required to include at least two, four-hour breaks in a 34-hour restart period. Unfortunately, this requirement will naturally lead to longer drive times for drivers, which could impact the growing driver shortage. Only time will tell if the requirement is modified further, but shippers should pay careful attention to any potential changes in the hours of service requirement that could apply before the end of this year.

3. Electronic Logging Devices

Many carriers have already implemented the ELD mandate. In a sense, the device is meant to reduce driver fatigue and workload concurrently. Drivers no longer will have to worry about documenting their hours manually, but it will increase the liability for drivers who go beyond the acceptable hours of service requirements. Consequently, carriers will need to extend their fleets to ensure all drivers are within these demands.

4. Driver Coercion

Driver coercion will be another major regulatory measure to watch for in 2016. While traditional methods of operation in the logistics industry have focused on departure-to-delivery times, driver anti-coercion measures will make it risky, if not illegal, to require drivers to deliver a given shipment within a prescribed time frame. If a carrier does impose such limitations on drivers, it could face stiff penalties and fines to the tune of $11,000 per incident and possible revocation of the authority to operate as a carrier. Mainly, going against this regulation, of all the trucking regulations, will cause a shipper to fail.

5. URS Database

The unified registration system will also be another Factor that will become essential in ensuring compliance and control throughout the logistics industry in 2016. Smaller shippers and carriers will no longer be able to evade enforcement action by restarting businesses and operations under new names with the launch of the URS database. As a result, it will be in the best interest of all carriers to ensure all appropriate enforcement actions and trucking regulations are implemented correctly and efficiently.

6. Drug and Alcohol Test Database

Rather than discussing the negative aspects of a drug and alcohol test database, which some drivers argue in trenches on their personal rights, the shipping industry will benefit greatly from a national drug and alcohol test database. This database will ensure drivers do not hook from carrier to carrier when a drug or alcohol issue arises. Mostly, this will cut down on risk and accidents on the road by keeping drivers accountable for their actions and preventing future incidents. Also, more advanced drug testing techniques, such as a hair follicle test, will become increasingly prevalent throughout the industry in 2016.

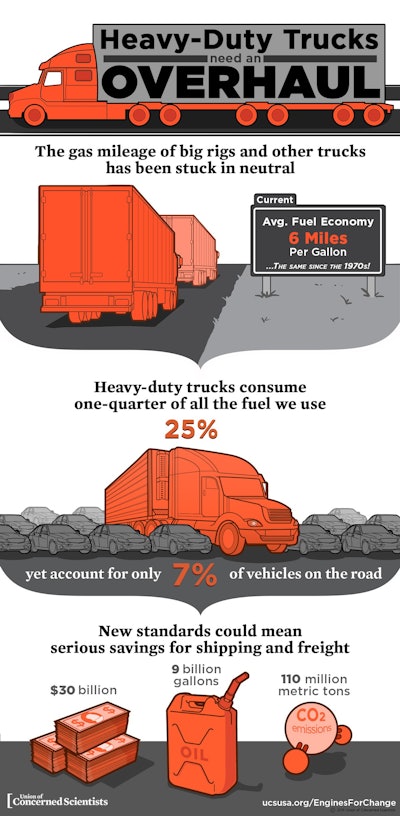

7. Greenhouse Gas Emissions Standards

The EPA will continue to Monitor and recommend changes to the gas and emission standards of commercial vehicles. Although increasing such trucking regulations seems like an overreach of power, these improved emission standards are designed to make fuel costs lower throughout to the economy, which will help shippers. Shippers need to consider phasing out older trucks in favor of more fuel-efficient models, and by 2021, shippers must have marked reductions in greenhouse gas emissions.

8. Electronic Stability Controls

2016 will also see you have returned to the mandated use of speed limiters on trucks. Although this requirement has been around for some time, mini shippers and carriers have not actually “installed” limiting parameters on these devices. Conversely, the growing oversight on the use of speed limiters will impact how long it takes a shipment to get from point A to point B. As a result, the driver shortage will become more prevalent as drivers become more incapable of meeting the demands that are being placed on the industry.

9. Driver Training

Carriers will also need to be mindful of changes and driver training requirements in 2016. The FMCSA has plans to change what requirements will be in place for new drivers and the demands of maintaining licensure. Furthermore, the changes in driver training may include accreditation criteria, which could make it harder for carriers to operate in-house training programs. Consequently, shippers will need to watch out for changes to driver training requirements above all else.

2016 will be a year of change in the logistics industry, and shippers need to pay attention. Compliance and regulatory measures will become increasingly important. Ignoring any of these changes, many of which have not been finalized, will dramatically increase the risk of fines and ability to continue operating. By understanding these trucking regulations, shippers can make sure their organizations remain in compliance and adhere to any new rules.

Adam Robinson is director of marketing for Cerasis, which provides transportation management solutions for shippers in North America.