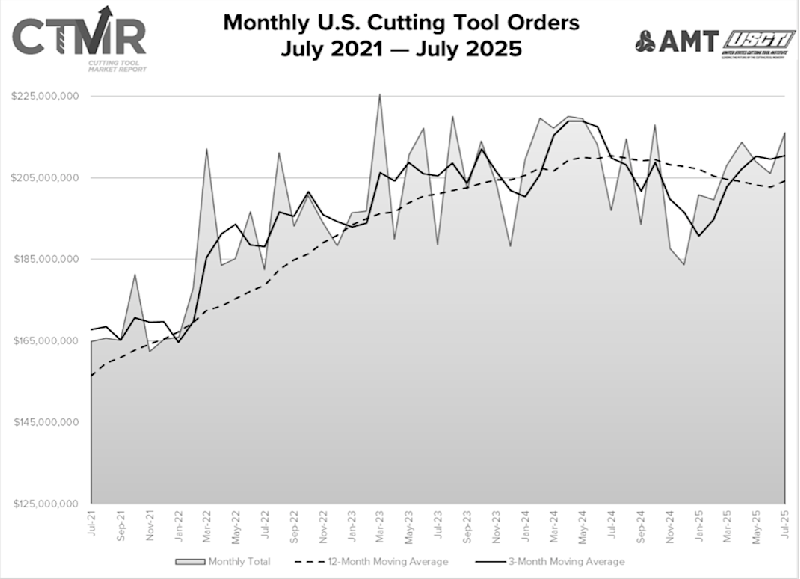

McLEAN, Va. — Shipments of cutting tools measured by the Cutting Tool Market Report, a collaboration between AMT – The Association for Manufacturing Technology and the U.S. Cutting Tool Institute, totaled $216.2 million in July 2025.

Orders increased 4.9% from June 2025 and 9.8% from July 2024.

Year-to-date shipments totaled $1.45 billion, down 2.9% from the same period in 2024.

“The latest trend is showing some modest growth compared to the previous months, which coincides with the activity of most shops,” said Jack Burley, chairman of AMT’s Cutting Tool Product Group. “They still have orders to fill and are not indicating any signs of slowing down. However, areas of concern remain for automotive, construction, and agricultural companies, where sales and tariffs are hitting hardest, causing delays for investment. More importantly, the tariff costs are settling in for most of the imported tools and raw materials, which may be stabilizing prices for now.”

Eli Lustgarten, president of ESL Consultants, said: “Current data suggests that the worst is over for the cutting tool sector, but businesses appear to be adopting a wait-and-see attitude. The outlook seems relatively flat, with a positive bias for the second half of the year and into 2026. End-market demand, which had been driven by aerospace, automotive, and heavy equipment, can now count only on the aerospace sector. The auto sector faces supply chain issues related to trade as well as the expiration of the EV incentives. Slower domestic economic growth and the effect of inflation on consumers indicate a slowing of auto production. The heavy equipment market appears flat, with possible positive trends in the construction sector because of reduced inventories, a slight pickup in trucks, and a possible improvement in mining. However, the outlook for the agricultural sector continues to deteriorate because of record yields and crops, rising carryovers, and declining prices, which have translated into a new round of layoffs.”

The Cutting Tool Market Report is jointly compiled by AMT and USCTI, two trade associations representing the development, production, and distribution of cutting tool technology and products. It provides a monthly statement on U.S. manufacturers’ consumption of the primary consumable in the manufacturing process, the cutting tool. Analysis of cutting tool consumption is a leading indicator of both upturns and downturns in U.S. manufacturing activity, as it is a true measure of actual production levels.