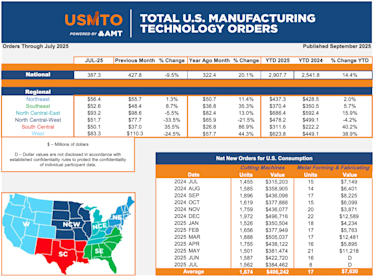

McLEAN, Va. — New orders of metalworking machinery, measured by the U.S. Manufacturing Technology Orders Report published by AMT – The Association For Manufacturing Technology, totaled $387.3 million in July 2025. This was a 9.5% decrease from June 2025 but a 20.1% increase from July 2024. Machinery orders placed through July 2025 totaled $2.91 billion, a 14.4% increase over the first seven months of 2024.

The value of orders in July 2025 is nearly 20% above what would be expected in July of an average year. This strong July increased the year-over-year total for the first time since April 2025. Despite the strong trends in the value of orders, the number of units being ordered shows continued flatness, as the number of units ordered in July 2025 was more than 13% behind an average July. In the absence of widespread inflation among machine tools, this trend underscores the continued importance of automation in current buying trends.

Machinery orders from contract machine shops in July 2025 decreased nearly 14% from June and rose just under 10% from July 2024, showing a significant softening relative to the overall market. While this trend is not uncommon, it shows the first signs of weakness in orders from the largest customer segment, which has otherwise shown signs of recovery for much of 2025.

New orders of machinery from agricultural equipment manufacturers have been on a declining trend since April 2025. Machinery investment from this sector, as well as from its supply chain, could see a sudden uptick in the coming months after John Deere announced additional investments in U.S. operations over the next decade.

Despite widespread expectations that the Federal Reserve will reduce rates at its September meeting, the latest forecasts continue to anticipate slowing industrial activity in the second half of the year, which could cause a softening in capital equipment purchases.

AMT’s 2025 MTForecast conference, which will be held Oct. 15-17 in Schaumburg, Illinois, will explore the probability of a downturn and what industries may still be areas of opportunity into 2026.