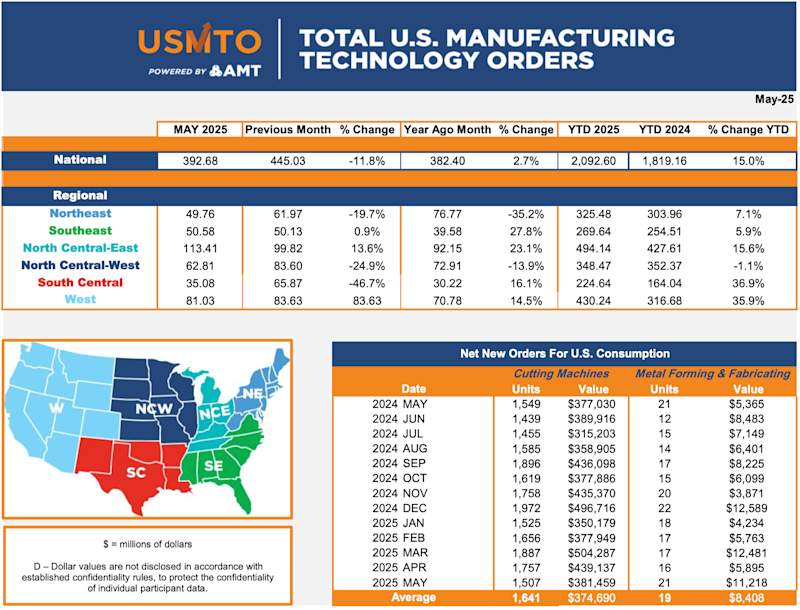

McLEAN, Va. — New orders of metalworking machinery, measured by the U.S. Manufacturing Technology Orders Report published by AMT – The Association For Manufacturing Technology, totaled $392.7 million in May 2025. This was an 11.8% decline from April 2025 and a 2.7% increase from May 2024. Machinery orders in 2025 placed through May totaled $2.09 billion, a 15% increase over the first five months of 2024.

While orders of manufacturing technology fell in March and April, the market continued to show signs of recovery, as every month in 2025 outperformed the same month in 2024. The value of May 2025 orders was 16% higher than the average May. When looking at the number of units ordered, the data shows far flatter growth. Through May 2025, the number of units ordered was 4.7% above the first five months of 2024, which is still the highest positive growth rate since 2021.

- Engine, turbine, and power transmission manufacturers made their largest investment in new metalworking machinery since February 2023. This is likely an extension of the outsized order activity trend in electrical equipment manufacturing due to increased grid demands from data centers.

- May 2025 machinery orders from the aerospace sector, which had the highest monthly order total on record in March 2023, fell to their typical monthly average but remain trending upward. Through May 2025, new factory orders for nondefense aircraft and parts were up 164% from 2024. Integrating these new orders into production schedules could exacerbate the rising capacity utilization rates of aerospace manufacturers without additional investments in manufacturing technology.

Manufacturing technology orders remained relatively strong in April and May 2025 despite the economic uncertainty caused by the irregular implementation of tariff policy over those months. The recently passed tax and spending policy package will provide a degree of certainty to all businesses and includes major incentives for manufacturers, which could lead to additional machinery investments in the second half of 2025.

AMT’s upcoming Summer Economic Webinar will explore how these developments could affect demand for manufacturing technology through the remainder of the year.