FCH Sourcing Network’s monthly Fastener Distributor Index (FDI) showed solid acceleration in May after a considerable April slowdown, evidence of a continued strong market for distributors of fastener products coming out of the waning COVID-19 pandemic, while the near-term outlook remains even better.

The May FDI checked in at 61.8 — up 3.1 percentage points from April. That followed a 7.3-point drop from March to April. Any reading above 50.0 indicates market expansion, which means May’s fastener market grew at a faster rate than April and has recovered well in recent months after holding in contraction territory (anything below 50.0) for much of 2020.

May’s reading was the sixth-straight month with a reading of at least 57.7.

For context, the FDI bottomed out at 40.0 in April 2020 amid the worst of the pandemic's business impacts on fastener suppliers. It returned to expansion territory (anything above 50.0) in September and has been in solid expansion territory since the start of this past Winter.

READ MORE: Fastenal May Sales Decline to Near 2019 Levels as Safety Plunges (published June 7)

iStock

iStock

“Net, respondents continue to see more demand than they can service given extended lead times, freight challenges, and material/staffing shortages,” commented R.W. Baird analyst David J. Manthey, CFA, about the latest FDI. “Respondent commentary focused on continued robust sales/order activity, however, extended lead times, challenges finding labor, and inflationary cost pressures were partial offsets.”

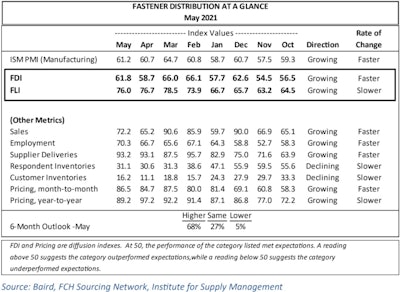

Of the FDI’s factoring indices, sales saw the biggest month-to-month jump with a 7.0 point increase to 72.2 in May. Employment gained 6.6 points to 70.3; supplier deliveries ticked up 0.1 points to 93.2; respondent inventories grew 0.5 points to 31.1; customer inventories increased 5.1 points to 16.2; month-to-month pricing gained 1.8 points to 86.5; and year-to-year pricing fell 8.0 points to 89.2.

While selling conditions remain very strong, FDI respondent commentary signals that some distributors are struggling to procure enough product. Here’s a sample of anonymous distributor comments:

- “Distributors starting to run out of critical stock, pricing continues to rise, domestic lead times continue to rise. New orders continue to be amazingly higher than last year with no sign of slowing.”

- “Continued strain in supply chain and raw materials are driving cost pressures. Transit market remains turbulent. Demand remains high.”

- “Deliveries are delayed from Taiwan and from the US ports and intermodals. Shortages everywhere followed by inflation across the board.”

- “Master Distributors - Suppliers are REALLY slow in shipments and inventory to distributors. And when they do have inventory, it could be coming from anywhere in the country. Lead times are out of this world.... might as well just go fishing!”

See the full May FDI table below: