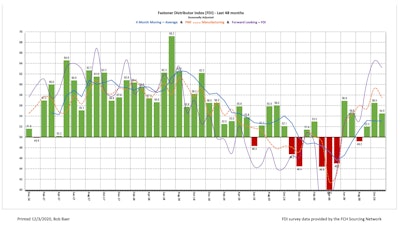

Coinciding with a modest slowdown in January US factory activity, the Fastener Distributor Index (FDI) from FCH Sourcing Network opened 2021 with a deceleration in January compared to December, though it's still well in growth territory.

After a surprising December surge, a January decelaration was somewhat expected, and it came in the form of a 5-percentage point decline to a mark of 57.7 percent. December's 62.6 FDI was its highest mark in two and a half years. January's reading was the fifth-straight growth month. The index hadn't checked in above 60.0 since November 2018 (62.2) and bottomed out at 40.0 in April 2020 during the worst of the COVID-19 pandemic's business impacts on the manufacturing sector. It has rebounded to hold in the low- to mid-50s for most of the eight months since.

For the index, anything above 50.0 indicates expansion and anything below 50.0 indicates contraction. Thus, Janjuary's reading indicates that the fastener distribution market continued to expand last month, albeit at a slower rate than in December

Last month's FDI surge came alongside another gain in FCH's Forward-Looking Indicator (FLI) — an average of distributor respondents' expectations for future fastener market conditions. The January FLI increased 1.0 percentage points from December to a mark of 66.7, it's best since at least 2019.

"Taking the FDI and FLI together, we believe January was a strong month for most fastener distributors relative to expectations," noted R.W. Baird analyst David Manthey.

The January FDI was powered by month-to-month increases in five of its seven factoring indices:

The biggest index factor driving the FDI's month-to-month decline was in sales, which sunk 30.3 points to 59.7. December's sales mark of 90.0 can be seen as an outlier, as no other month in the past eight months was above 79.2.

Here's how the January FDI's other factoring indices fared:

- Employment increased 4.5 points to 64.3 - its highest mark since at least early 2019

- Supplier deliveries increased 7.9 points to 82.9 - its highest mark since at least early 2019

- Respondent inventories fell 8.8 points to 47.1 - its lowest mark since at least early 2019

- Customer inventories fell 4.6 points to 24.3 - its lowest mark since at least early 2019

- Month-to-month pricing increased 12.3 points to 81.4 - its highest mark since at least early 2019

- Year-to-Year pricing increased 0.3 points to 87.1 - its highest mark since May 2019

Looking at expected activity levels over the next six months, sentiment held strong in January:

- Only 6 percent of respondents expect lower activity over the next six months, identical to December and down from 8 percent in November

- 69 percent expect higher activity, compared to 79 percent in December and 78 percent in November

- 26 percent expect activity to remain the same, compared to 15 percent in December and 14 percent in November

Recapping respondent commentary, Manthey noted that "Nearly every comment touched on current logistics and transportation issues. Freight appears to be one factor driving pricing higher for many respondents, in addition to raw material shortages and steel price increases."

See the full FDI January chart below, as well as for the previous 48 months: