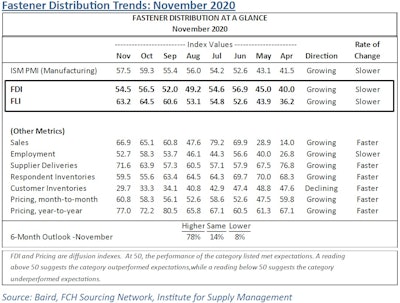

A couple of days after the latest manufacturing PMI from the Institute for Supply Management showed a modest month-to-month decrease in November, FCH Sourcing Network's monthly Fastener Distributor Index (FDI) likewise showed a nearly equal decrease, though still in expansion territory.

The FDI — a monthly survey of North American fastener distributors, operated by FCH in partnership with R.W. Baird — showed a seasonally-adjusted November reading of 54.5, down 2 percentage points from October. That figure recently topped out at 56.9 in June before falling into the negative at 49.2 in August, but has rebounded shortly after.

For the index, anything above 50.0 indicates expansion and anything below 50.0 indicates contraction. Thus, November's reading indicates that the fastener distribution market continued to expand last month, albeit at a slower pace than in October.

The month-to-month decrease came despite continued strong readings in the FDI's Forward-Looking-Indicator (FLI), which measures distributor respondents' expectations for future fastener market conditions. At 63.2, the November FLI was down 1.3 points from October but was its third-straight month with at least a 60.6 reading after a recent low of 53.1 in August.

"As last month’s FLI was the highest recorded since January 2018, we were not surprised to see the FLI settle down some in November," commented David Manthey, CFA and R.W. Baird analyst. "That said, with the FLI well above 50, customer inventories getting increasingly low, and continued improvement registered in respondents’ six-month outlooks, we believe the FDI should see additional expansionary readings ahead, implying continued m/m improvement even though sales trends may remain down on a y/y basis for many respondents."

Of the FDI's seven other factoring indices, five showed month-to-month increases:

- Sales improved 4.8 points to 66.9

- Employment decreased 5.6 points to 52.7

- Supplier Deliveries jumped 7.7 points to 71.6

- Customer Inventories decreased 3.6 points to 29.7

- Month-to-Month Pricing increased 2.5 points to 60.8

- Year-to-Year Pricing increased 5. points to 77.0

Looking at expected activity levels over the next six months, sentiment continued tp strengthen in October:

- Only 8 percent of respondents expect lower activity over the next six months, compared to 6 percent in October and 15 percent in September

- 78 percent expect higher activity, compared to 72 percent in October and 61 percent in September

- 14 percent expect activity to remain the same, compared to 22 percent in October and 24 percent in September.

See the full FDI November chart below: