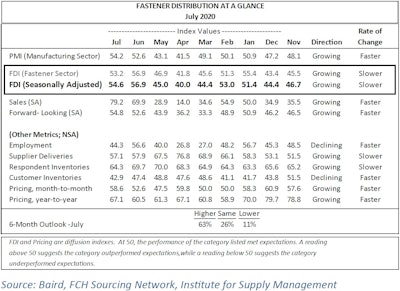

FCH Sourcing Network's monthly Fastener Distributor Index showed a mild month-to-month slowdown during July, though its latest reading is still in expansion territory and far above March-May that greatly suffered from COVID-19 industrial shutdowns.

July's seasonally-adjusted FDI reading was 54.6, following a June mark of 56.9 that had a massive 11.9-percentage point gain from May. Down only 2.3 points from June, the latest reading suggests fastener distribution may have found at least a temporary new normal amid the pandemic. For perspective, March, April and May had readings of 44.4, 40.0 and 45.0.

For the index — a monthly survey of North American fastener distributors, operated by FCH in partnership with R.W. Baird — any reading above 50.0 indicates market expansion, while anything below 50.0 indicates contraction. June was the index's best reading since November 2018's 58.2.

In July's FDI, four out of its eight metrics showed month-to-month gains, led by strong improvements in sales, month-to-month pricing and year-to-year pricing, while the index saw considerable month-to-month weakness in employment, supplier deliveries and customer inventories.

In metrics, compared to June:

- Seasonally-adjusted sales jumped 9.3 percentage points to 79.2

- The FDI's forward-looking-indicator (FLI) — which measures distributor respondents' expectations for future fastener market conditions — improved another 2.2 points, following gains of 8.7 and 7.7 points in June and May. The FLI has improved 21.5 points since bottoming out at 33.3 in March.

- Employment sunk 12.3 points to 44.3. That metric bottomed out in April at 26.8.

- Supplier deliveries dipped 0.8 points to 57.1

- Respondent deliveries fell 5.4 points to 64.3

- Customer deliveries fell 4.5 points to 42.9

- Month-to-month pricing jumped 6 points to 58.6

- Year-to-year pricing jumped 6.6 points to 67.1

"As a diffusion index, the 54.6 reading indicates the trajectory of sales trends is improving m/m, but activity levels are likely not yet near pre-COVID levels (i.e., market conditions were much stronger in February 2020 despite a 53.0 FDI vs. a 54.6 this month, but trends are increasing at a faster m/m rate now than in February 2020)," commented David Manthey, CFA, about the July FDI. "Looking at the drivers of the m/m moderation in the FDI, sales trends continued to improve, but the employment index slightly decreased, dragging down the overall index."

Looking at expected activity levels over the next six months, sentiment improved slightly further from June:

- Only 11 percent of respondents expect lower activity over the next six months, identical to June and a considerable improvement from 28 percent in May and 54 percent in April.

- 63 percent expect higher activity, compared to 61 percent in June, 43 percent in May and 34 percent in April

- 26 percent expect similar activity, compared to 29 percent in June, 30 percent in May and 12 percent in April

Manthey shared a couple of survey participant quotes for the July index:

- “[I] expect activity to increase unless there is a setback with the economy relating to the virus.”

- “Sales in July were surprisingly higher than expected and higher than June. That said, we continue to expect the line to flatten and a decrease in sales for Q3-Q4 compared to last year.”

- “Automotive related still very slow."

- “Vendors in US and abroad are way slower."

PPE, Reshoring Suppliers, and Online Competition

FCH Sourcing Network asked three supplemental questions in the latest FDI survey, covering whether fastener distributor respondents carry PPE products and if they have increased its inventory; If they have shifted to looking more at domestic suppliers; and if they've felt increased competition from online marketplaces. The results showed that 58 percent of respondents do not carry PPE, but 30 percent have increased PPE on a small scale amid the pandemic. On the supply chain front, 53 percent said they have made at least a small shift toward looking more closely at domestic suppliers. Lastly, 56 percent said they've felt some level of increased market pressure fro online marketplaces.

See the full FDI July chart below: