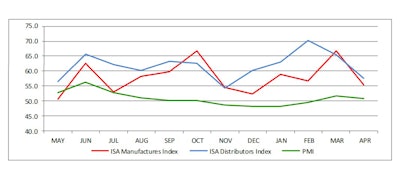

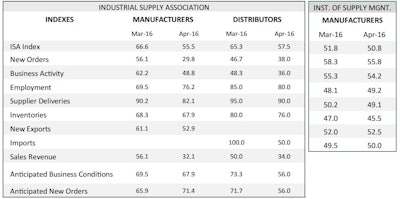

The Industrial Supply Association posted its April Economic Indicator on Thursday, led by declines in all three indexes — ISA's Distributors Index, ISA's Manufacturers Index and the Institute of Supply Management's PMI (Purchasing Managers Index).

The Distributors Index declined for a second straight month, down from 65.3 in March to 57.5 in April. The Distributor Index peaked at 70.3 in February.

The Manufacturers Index had a considerable decline from 66.6 to 55.5, following a healthy February-to-March gain. The March Manufacturers Index reading was its highest since October.

Meanwhile, the ISM PMI had a slight dip from 51.8 to 50.8.

For each index, a reading above 50 percent indicates expansion, while a reading below 50 percent indicates contraction. So while the indexes still indicate growth for ISA members, April was at a slower pace.

"However, indications are that the coming months seem positive," ISA said in its report Thursday.

Here is a selection of comments from manufacturers in regards to the latest numbers. There were no comments from distributors:

- "Business activity better last two months than first two months of 2016. Energy sector is main driving issue. Optimistic about 2nd half of 2016."

- "Base business is still negative compared to last year - new orders have boosted sales."

- "April rebounded from a slowdown in March. New Orders are still spotty. I am hoping to maintain current pace but do not see any real growth soon."

- "Still not seeing any bounce-back as we thought by now, perhaps the election is keeping these current levels we really can't say. Considering the forecasters/economist had our industry trending up moving into one of the best years on record in 2017, its been anything but."

- "We started to see orders improving in March, then dropped off again in April."

- "Month started strong but got more erratic as we moved through the month. Still having trouble putting five good days together or several good weeks to make a good month."

- "Still experiencing steady but sluggish market conditions. We expect somewhat better conditions in the Q3 and Q4 but not great."

- "We are seeing some indications that the bottom is close."

- "We're very busy. Finding it extremely difficult to hire good help which is nothing new, but getting more difficult as time goes on, even with beginning wages at 2X the minimum."

- "The economy slowed in Q1 and we felt it."