As we continue to explore the specific impacts the pandemic has had on industrial distributors, we’ve worked to consistently keep our readers attuned to the activities of their peers amid a shifting business environment.

This Fall, we polled nearly 100 distribution executives and managers, asking how the pandemic has impacted their operations and the results point to both challenges and opportunities.

Perhaps some of the most interesting information gleaned from our survey pertains to e-commerce and how well-prepared -- or not -- industrial distributors were when a significant purchasing shift occurred at the outset of the pandemic.

During the height of the first wave, e-commerce spending ballooned, with Digital Commerce 360 reporting year-over-year increases of 78 and 76 percent in June and July, respectively.

With many distribution company sales reps and rep agencies sidelined -- and customers hunkering down -- the shift to online spending was inevitable. And though the massive swings reported in the summer have waned a bit as businesses have re-opened, it may be the industry is permanently changed. Nearly 78 percent in our survey pool said that the pandemic has increased distributors’ need for effective e-commerce solutions. And while this shouldn’t come as a huge shock, it’s clear that many companies likely feel this way because they weren’t prepared.

Of those distributors already offering some kind of e-commerce solution pre-pandemic, only 4 in 10 said that it was adequate to handle the shift to online. In our annual Survey of Distributor Operations, published earlier this year, 62 percent of our surveyed audience said that e-commerce was “a priority” for them, though this latest result suggests that, at least for some, their efforts to focus in this area weren’t enough.

This very visible gap, impacting almost every market, has been enough to accelerate the need for improvements from a technology side. A recent report in Entrepreneur said that 40 percent of small businesses across all industries don’t have a website at all, but cites data from Domain.me, contending registrations for new domains in the past few months have been “significant” as companies scramble to meet the crush of online demand.

And while distributors, especially smaller, independent ones, have long-been accused of being “laggards” in the area of tech, the pandemic may have provided a nudge in the direction of digitization and e-commerce. When we asked distributors if they’d be ramping up investments in business technology due to pandemic-related conditions, more than 61 percent said yes.

And while investments in tech in the near-term should yield long term cost savings through efficiency, transparency and customer retention, distributors are also looking for other ways to increase capital as the pandemic has torn through their balance sheets.

In part 1 of this video, ID’s managing editor Mike Hockett explored some of the cost cutting measures distributors told us they were implementing, including job and salary cuts and renegotiations with suppliers on rates and terms.

But what we didn’t yet cover were the expansions. As distributors contended with slumping revenues, many were also faced with increased demand for certain product categories, specifically PPE or other safety items, as well as jan-san products like cleaning chemicals and sanitizers.

This resulted in nearly 42 percent of our survey respondents adding product lines since the start of the pandemic. Overwhelmingly, these products related to the pandemic response and included, for many, disinfectants, sanitizers and an expanded breadth of PPE such as masks and gloves. Several distributors also relayed a continued focus on value-add.

For some companies, committing to expand didn’t quite cut it. Even with a desire to add product depth to respond to customer demand, some businesses have struggled to find these high-demand products, which may have been an influencing factor for the 46 percent who said their product mix stayed the same.

As we look ahead, there are reasons for caution as well as optimism. First, the pandemic, as we know, is far from over and a cloud of uncertainty overshadows the end of this year and into next. But with vaccine developments coming hard and fast, the overarching business landscape could change immensely in the coming year, though economists have cautioned businesses to buckle up for a bumpy ride.

Meanwhile, industrial distributors can continue to play a key role in helping their customers operate safely and efficiently throughout this time. And while stressors certainly inhibit the kind of easy growth many experienced in some of the preceding years, distributors have shown themselves to be nimble and, in many cases, candid about their prospects and in identifying areas for improvement.

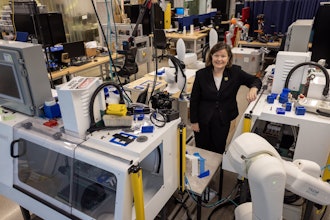

If you didn’t get a chance to see the first segment of our coverage, you can find a link to that here. I’m Anna Wells. Thanks for joining us, ID subscribers; may you continue to optimize your business environment and enhance the opportunities in 2021.