This article is an abstraction from a report by Tompkins International as printed in the May/June 2013 issue of Industrial Distribution. To read the full report, please visit the site listed at the end of the article.

Near the intersection of business as usual and success going forward sits industrial distribution strategy: increasing online sales, technology, omnichannel, multichannel, and social media. The buyer is now in the driver’s seat, and AmazonSupply represents more than just a toe in the water. Amazon’s dedicated industrial B2B site could lead to its dominance in the MRO market, whether industrial distributors realize it or not.

Business questions that were once heavily debated no longer matter as much at this crossroads. These questions include where to locate branches, DCs, fulfillment centers, and how to minimize the cost of the distribution network. At these crossroads, we must address strategy before structure.

There are two ways to view the current industrial distribution crossroads:

1. A long-term perspective: The industrial distribution industry has traditionally been highly fragmented with many small regional players. The industry was built around individual product groupings which relied on specialized knowledge and technical expertise to drive sales. Consolidation was caused by two reasons. First, it was driven by the desire to improve leverage in a given category. Secondly, it came in response to larger customers looking for full-line suppliers to partner with on integrated supply and national contracts. This consolidation has changed the landscape.

2. A short-term perspective: Larger players who have obtained critical mass have a strong and growing presence in e-commerce. W. W. Grainger cites e-commerce as its fastest growing segment, with 25 percent of current sales online. The percentage is expected to rise to 40 to 50 percent by 2015. AmazonSupply will be a formidable competitor in this arena. Medium to small size players, who have yet to enter the market, will see a slow but steady erosion of sales and margins as Amazon fine tunes inventories, leverages its delivery proposition, and tackles the technical support side of the equation.

Starting now, businesses need to have an e-commerce strategy that supports their abilities to make technical sales. Business strategy, customer expectations, and technology are converging to create the perfect storm as a result of both the long and short term transformations.

Five Pillars of Success: What Do Customers Really Want?

A great deal of time and money has been spent on the question of customer needs, but it really boils down to these five pillars —

Competitive Prices: Today’s MRO buyers expect good value for the money and have a strong awareness of the total price of the items they need to buy. Their ability to have total price transparency presents a clear expectation for price competitiveness. Not only is AmazonSupply providing competitive pricing, but they are setting the stage for changing expectations on shipping. The site offers free shipping on orders over $50, free and low-cost expedited shipping for Amazon Prime members, and free 365-day returns.

Product Breadth: Full-line industrial distribution is becoming the norm among large-scale players. Amazon refers to this as the “endless aisle” in its retail segment, and with a starting offering of 500,000 items, AmazonSupply will look to use this same approach in industrial supplies. Therefore, limiting selection is not a strategy that will work in the future.

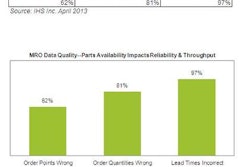

Availability: Price and selection are a good start, but in addition, today’s MRO buyers very often make the buying decision based on in-stock availability. Customers are looking for the perfect order. Order accuracy should be a given; no one wants to deal with the waste associated with returns and further delays. Availability also includes the best possible lead times on non-stock items. Industrial distributors need to be sure they are collaborating with suppliers on lead-time reduction, improved performance on PO fulfillment rates, and managing information flows. Order placement, acknowledgement, and quoted delivery times need to be instantaneous from end-to-end in the supply chain. Point of sale data and forecasting at the SKU/branch level are the keys to creating a more reactive supply chain.AmazonSupply has the tools in place to cover these bases, and the speed of information flow will serve as a competitive advantage.

Speed of Delivery: For now, MRO buyers will accept up to three- to four-day delivery. Going forward, same-day or next-day delivery will be the norm for most items. Consider that today in China, delivery for consumer items is not measured in same-day or next-day terms, but in hours. Distributors need to design their branch/DC networks, logistics, and operations to meet the new standard of same-day or next-day delivery. Careful consideration on innovative ways to provide this level of service must be given. The indiscriminate addition of branch locations to meet this challenge could create unsustainable cost structures.

Technical Support: There is no doubt that technical support helps, both in on-site consultation to tough problems or over the phone. Searching for the best solution will always be an important part of the services offered by distributors. Integrating technical support into the e-commerce experience is the challenge. The self service model of the future driven by a connected youth culture must address this issue by investing in keyword search capabilities and extensive SKU-level data. Again, there will always be a need to talk to (or chat with) an expert. AmazonSupply is addressing both, by leveraging its extensive experience in search, and the user-friendly presentation of product details that focuses on the characteristics that matter most, as well as building a call center for live support.

Increasingly, MRO buyers are saying: “Bring me solutions that address my needs on price, availability, and service. Customize those solutions to make doing business easier by integrating with the way I want to do business, and you will be rewarded with a higher share of my spending.” More importantly, the ability to execute the perfect order will be the price of admission — failing in execution will result in not being given an opportunity to participate.

The Future: MOE (Multichannel Operations Excellence)

As industrial distribution continues to evolve, it is clear that neither the AmazonSupply 2012 model nor the MRO branch model will be where industrial distribution is headed in the future.

Instead, a major transformation will propel industrial distributors to a whole new place – one that allows immediate responses to customer expectations and rapid adoption of new innovations in the marketplace. Some have taken hold of the word “omnichannel” to represent the correct path, but since omnichannel is a relatively new word, move forward with caution. The thinking behind omnichannel is that distributors need to interact with customers in an integrated, consistent way (think channel continuity, or sometimes termed “enterprise selling”) via many channels (websites, branches, catalogs, integrated supply, social media, mobile devices, peer to peer integration, etc.) that provide customers with endless value and satisfaction.

But to move beyond the crossroads, industrial distributors need to provide excellence within several channels as well as the omnichannel. Engaging and serving customers under their own terms (how, when, and where) compels distributors to achieve MOE.

MOE demands that every aspect of industrial distribution be interactive, educational, engaging, and personalized. Distributors who employ MOE will set the pace for the next decade as well as define distributor excellence for the next 50 years. But approaching MOE requires a major transformation.

This is not saying that pure online or pure branch will fail. To the contrary, these models can be made to work if distributors are involved in multichannel in all cases. A pure online distribution should use multiple online channels such as Google, and Yahoo, and a branch should use Facebook, Groupon, and similar outlets.

In this age of connectivity, mobility, and social networking, distributors will need to focus on adapting to how their customers make decisions and purchases. Multichannel access may involve branch events by reaching out to customers in new ways; or integrating online and physical operations to leverage the access with customers (online order with branch pick-up, or returns, and branch selection with delivery); or partnering with competitors to broaden the selection and availability; or integrating online and/or branch events with social media such as Twitter and Facebook.

Regardless, achieving MOE requires the adoption of new processes and technologies so that effective selling techniques will continually delight customers.

Once company leaders begin to understand MOE, how do they begin moving beyond the crossroads? Read the full report from Tompkins at www.tompkinsinc.com/id-crossroads.