FCH Sourcing Network reported its Fastener Distributor Index (FDI) for the month of October on Nov. 5, led by an overall improvement that snapped two straight months of decline, despite ongoing supply chain headaches.

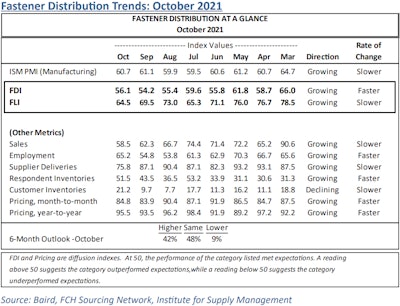

Last month's FDI showed a reading of 56.1 — up 1.9 percentage points from September, which was the index's weakest reading in 12 months. Any reading above 50.0 indicates market expansion, while anything below that indicates contraction.

The FDI has been in expansion territory each month since September 2020, most recently peaking at 61.8 this past May and has held in the mid-50s for the past three months.

Meanwhile, the index's Forward-Looking-Indicator (FLI) — an average of distributor respondents' expectations for future fastener market conditions — had a notable decline for a second-straight month. October's FLI of 64.5 was down a whole five points from September. While still in strong expansion territory, it's been a considerable 8.5-point drop over the past two months. The FLI was in the mid-to-high-70s throughout this past spring before falling to 65.3 in July. It rebounded nicely to 73.0 in August but has fallen since.

The FLI has been at least in the 60s each month beginning with September 2020.

Overall, the index's latest figures suggest a slightly better October for fastener distributors than September, with forecasted market conditions less optimistic than a month ago.

"Commentary remains focused on very elevated freight costs, shipping congestion and raw material/semiconductor chip shortages, although demand commentary was again generally favorable," commented R.W. Baird analyst David J. Manthey, CFA, about the latest FDI readings. "The FLI moderated for the second consecutive month, reading 64.5, on slightly higher respondent/customer inventory levels, which the FLI reads as a negative for future demand (less restocking needed) but could actually prove to be a positive in terms of ability to meet demand. Net, October market conditions strengthened but respondents cast a cautiously optimistic forward view in light of continued supply chain/labor constraints.'

Of the FDI’s seven factoring indices besides the FLI, two saw month-to-month declines in October. Most notably, the sales index fell 3.8 points to 58.5. After holding in the low 70s from May to July, the sales index has fallen 15.9 points in the past three months. Likewise, the supplier deliveries index fell 11.3 points in October to 75.8 — its lowest mark of the year.

There were positives, however. The FDI's Employment index improved 10.4 points to 65.2; Respondent Inventories increased 8.0 points to 51.5; and Customer Inventories improved 11.5 points to 21.2.

On the pricing side, the FDI's indices for that expectedly increased. Month-to-Month Pricing increased 0.9 points to 84.8, and Year-to-Year Pricing increased 2.0 points to 95.5.

"Pricing picked up modestly as the proportion of respondents reporting higher pricing m/m was 73 percent compared to 71 percent last month," Manthey noted.

Manthey added that FDI survey commentary focused on issues of raw material shortages (especially stainless steel), freight costs (which one respondent said was 4x the normal cost) and potential additional shipping congestion heading into the holiday season.

Here’s a sample of anonymous distributor comments from the FDI's October survey:

- “Deliveries not improving. Distributors all searching for the same parts, vanishing inventory levels. No end in sight!”

- “Raw material deliveries still problematic. Wire vendors continue to push deliveries out into 2nd quarter 2022, especially on stainless steel.”

- “Slow supply chain is a real challenge in purchases & receiving goods import & domestic made.”

- “Inventory that has been lost in transit purgatory has finally begun to show up. Attention must be paid to demand trends and managing inventories moving forward, with the challenges mainly pertaining to continued shipping congestion through the holiday and CNY season.”

- “Sales are incredible. Up almost 40% YTD over last year and almost 30% from 2019.”

See the full October FDI table below: