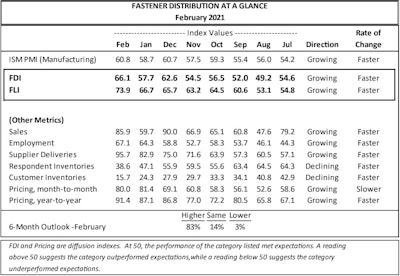

After a decent deceleration in January, FCH Sourcing Network's Fastener Distributor Index (FDI) rebounded in a big way in February — which is traditionally a softer month for the industry.

The FDI jumped 8.4 percentage points in February to a mark of 66.1 — its best reading since July 2018 (69.2) — as the index's six-month-outlook measure reached a record-high.

The FDI has seen a remarkable recent turnaround, as it was already in contraction territory (anything below 50.0) before the COVID-19 pandemic hit. The FDI was in the mid-40's in November-December 2019, recovered modestly and then bottomed out at 40.0 in April 2020 amid the worst of the pandemic's business impacts. The FDI was still in contraction territory as recently as August (49.2), but has been in expansion territory since, and February's mark and outlook sentiment points to continued strong performance for the fasteners market.

The most promising figure in the newest FDI is its forward-looking-indicator (FLI) — an average of distributor respondents' expectations for future fastener market conditions. February's FLI jumped another 7.2 percentage points from January to an all-time best mark of 73.9, despite extreme concerns over supply chain and pricing issues noted by R.W. Baird analyst David Manthey. The FLI has been in the 60s each month beginning with September 2020.

"Net, we believe February was a strong month for most fastener distributors relative to expectations," Manthey said about the latest FDI findings. "A robust 69 percent of respondents saw better than seasonally expected sales in February, which is consistent with levels seen over the last three months. Inflationary pressures, particularly in steel and freight costs, continue to be felt by many respondents. Additionally, supplier lead times remain very extended, leaving some respondents concerned about their ability to meet future demand."

FCH Sourcing Network

FCH Sourcing Network

The February FDI showed that sales, employment and supplier deliveries made solid month-to-month improvement, while inventories continued to decrease — evidence of a clearing backlog.

Here's how the February FDI's factoring indices fared:

- Sales surged 26.2 points to 85.9. It has shown volatility in the last few months, jumping from 66.9 in November to 90.0 in December and dropping back to 59.7 in January.

- Employment increased 2.8 points to 67.1 - its highest mark since at least early 2019

- Supplier deliveries jumped 12.8 points to 95.7 - its highest mark since at least early 2019

- Respondent inventories fell 8.5 points to 38.6 - its lowest mark since at least early 2019. It had hovered between the mid-60s to mid-50s through most of 2020.

- Customer inventories fell 8.6 points to 15.7 - its lowest mark since at least early 2019.

- Month-to-month pricing dipped 1.4 points to 80.0, one month after jumping 12.3 points

- Year-to-Year pricing increased 4.3 points to 91.4 - its highest mark since May 2019. It was in the low-70s as recently as October 2020.

Looking at expected activity levels over the next six months, sentiment grew even more positive in February:

- Only 3 percent of respondents expect lower activity over the next six months, compared to 6 percent to January

- 83 percent expect higher activity, compared to 69 percent in January

- 14 percent expect activity to remain the same, compared to 26 percent in January

Recapping respondent commentary, Manthey noted that "For the second consecutive month, nearly every comment touched on raw material inflation and logistics issues. Congestion at the ports, container shortages, and weather challenges are causing significant logistics disruptions."