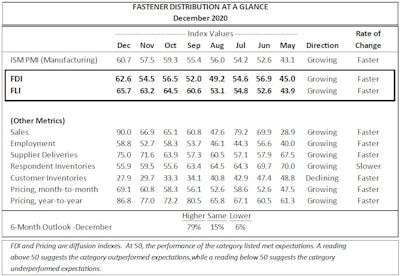

A couple of days after the latest manufacturing PMI from the Institute for Supply Management showed a solid month-to-month increase in December, FCH Sourcing Network's monthly Fastener Distributor Index (FDI) showed a considerably larger jump to its highest mark in two and a half years.

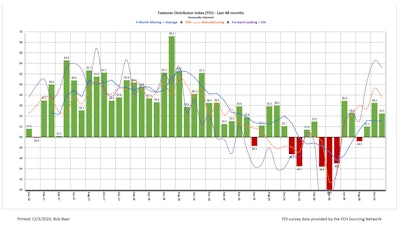

The FDI — a monthly survey of North American fastener distributors, operated by FCH in partnership with R.W. Baird — had a December reading of 62.6 percent. That's its best since July 2018's 69.2. The index hadn't checked in above 60.0 since November 2018 (62.2) and bottomed out at 40.0 in April 2020 during the worst of the COVID-19 pandemic's business impacts on the manufacturing sector. It rebounded to hold in the low- to mid-50s in five of the past six months, including 54.5 in November, before December's spike.

For the index, anything above 50.0 indicates expansion and anything below 50.0 indicates contraction. Thus, December's reading indicates that the fastener distribution market continued to expand last month, and at a much faster rate than in recent months.

The latest reading was quite the year-over-year contrast, as December 2020's FDI — still at least two full months before the pandemic became known in North America — was at 44.4.

Last month's FDI surge came alongside another gain in FCH's Forward-Looking Indicator (FLI) — an average of distributor respondents' expectations for future fastener market conditions. The December FLI increased 2.5 percentage points from November to a mark of 65.7, it's best of the year.

The December FDI was powered by month-to-month increases in five of its seven factoring indices:

- Sales spiked 23.1 points to 90.0

- Employment increased 6.1 points to 58.8

- Supplier deliveries increased 3.4 points to 75.0

- Respondent inventories decreased 3.6 points to 55.9

- Customer inventories decreased 1.8 points to 27.9

- Month-to-month pricing increased 8.3 points to 69.1

- Year-to-year pricing increased 9.8 points to 77.0

Looking at expected activity levels over the next six months, sentiment continued tp strengthen in December:

- Only 6 percent of respondents expect lower activity over the next six months, compared to 8 percent in November, 6 percent in October and 15 percent in September

- 79 percent expect higher activity, compared to 78 percent in November, 72 percent in October and 61 percent in September

- 15 percent expect activity to remain the same, compared to 14 percent in November, 22 percent in October and 24 percent in September.

See the full FDI December chart below, as well as for the past 48 months: