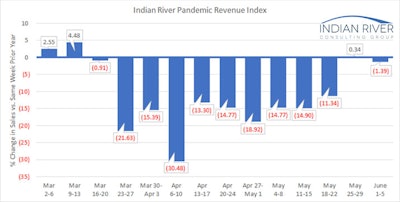

One week after finally turning back to positive territory after nine straight weeks of double-digit declines, Indian River Consulting Group's (IRCG) distributor Pandemic Revenue Index (PRI) dipped back below the breakeven mark last week.

For the week of June 1-June 5, the PRI checked in at -1.39 percent, following a +0.34 showing the week of May 25-May 29. The latest figure means that for the 10 distributors surveyed in last week's PRI, they had an average year-over-year sales decline of 1.39 percent.

While back in the negative, last week's PRI is still far better than it was throughout late March and all of April and May during the peak of COVID-19 business shutdowns.

The PRI showed a mark of +0.34 for the week of May 25-May 29, meaning that for the group of 10 distributors surveyed, their combined average year-over-year sales improved 0.34 percent last week. That follows marks of -11.34 percent for the week of May 18-22. For context, the PRI first went negative during the week of March 16-20 at -0.91, plummeted to -21.63 the week after and then bottomed out at -30.48 the week of April 6-10. The index held steady between -13 to -19 for the next five weeks and improved 3.56 percentage points the week of May 18-22 before a considerable recovery in late May and has held relatively steady these past two weeks.

"While two points does not make a trend, we’re considering the external circumstances where states are loosening restrictions on business activity," commented Mike Emerson, IRCG partner. "That, plus a surprising jobs report for May, just might signal that we’ve turned the corner on phase one."

Emerson noted that the distributors that seem to be suffering the greatest losses are those whose customers are unlikely to be considered essential businesses defined by state and local definitions, as well as those focused more on MRO markets.

"This would make sense as businesses that aren’t open aren’t buying products," Emerson said. "With general output down, there is less need for repair and maintenance products."

If you are interested having your distribution firm participate in the PRI, reach out to Emerson at [email protected].

The PRI was launched in late March to provide the B2B distribution space with a snapshot of how distributor revenues are doing amid the COVID-19 pandemic.

The chart below shows the percent change in sales in 2020 compared with the same week in 2019.