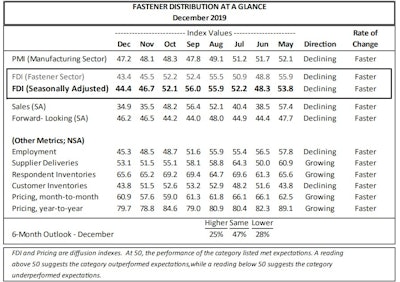

The Fastener Distributor Index (FDI) — operated by FCH Sourcing Network in partnership with R.W. Baird — for December was posted on Thursday, showing that activity and sentiment in the sector slowed even further vs. November and dipping further into contractionary territory to an all-time low. December's reading was the lowest since the FDI's inception in January 2012.

Following a 5.4-percentage point drop from October to November, the seasonally-adjusted FDI fell another 2.3 points from November to December to a mark of 44.4. That edges February 2016's mark of 44.5 as the index's worst-ever reading, with that previous low coming during a stretch of mid-40s readings during the midst of that year's industrial recession tied to plummeting oil and gas rig counts.

For the index, any reading above 50.0 indicates expansion, whereas anything below 50.0 indicates contraction.

December's slump follows November's FDI that had the most precipitous one-month drop in more than three years.

The FDI's Forward-Looking-Indicator (FLI) — measuring distributors' outlook for the next six months — dipped 0.3 points from October to a mark of 46.2, indicating increased pessimism out the industry's near-term outlook.

"Overall, December fastener market conditions were soft for the second consecutive month, while respondents’ implied January forecasts are for less bad demand conditions given an improved (but still sub-50) FLI," commented R.W. Baird analyst David Manthey.

The index had been in expansion territory for 20 consecutive months before dipping to 48.3 this past June, recovering over the summer to a peak of 56.0 in September before declining each month since.

In December's FDI, the seasonally-adjusted sales index fell 0.6 points to a mark of 34.9, following an October-to-November drop of 12.5 points. In other December metrics, Employment fell 3.2 points from November to 45.3 and Customer Inventories fell 7.7 points to 43.8. On the positive side, Supplier Deliveries gained 1.6 points to 53.1; Respondent Inventories ticked up 0.4 points to 65.6; Month-to-Month Pricing increased 3.3 points to 60.9 and Year-to-Year Pricing increased 0.9 points to 79.7.

The index's six-month outlook showed moderate deterioration compared to November and remained somewhat muted overall, with 28 percent of respondents now expecting lower activity six months from now (compared to 27 percent in Nov.), 47 percent expecting similar activity (Nov. 42 percent) and 25 percent expecting higher activity (Nov. 30 percent)

According to the FDI, respondent commentary skewed negative. "Feedback on the demand environment suggest a generally weaker pace of business activity currently," December's report said. "One respondent commented, 'November/December [were] down from the earlier months of 2019. Customers pushed out deliveries to 2Q20 instead of taking in inventory at end of 2019.' Another commented, 'Heavy Truck market showing considerable slowing for the past couple months.'"

See the full December FDI chart below:

Source: Baird, FCH Sourcing Network, Institute for Supply Management

Source: Baird, FCH Sourcing Network, Institute for Supply Management