As it approaches its 20th anniversary, Platte River Equity counts a wide range of lower-middle-market industrial companies among its more than 70 acquisitions to date — including, increasingly, those on the distribution side of the market.

Over the past five years, the Denver-based private equity firm has added a slew of distributors, including Missouri safety and fall protection provider GME, conveyor distributor Belt Power, hydraulics, pneumatics and automation provider Womack Group, and fluid conveyance and sealing distributor TIPCO Technologies.

As the firm works to bolster those companies – and potentially add more – its industrials investment team aims to identify and embrace the trends and technologies that will make the difference for distribution companies in the coming years.

Peter Calamari and Mark Brown, managing directors at Platte River Equity and co-leaders of the firm’s industrials practice, recently discussed what’s next for distribution – and how its companies are working to meet it – with Industrial Distribution.

What do you expect will be the most important technology trends for industrial distributors in the coming years?

Mark BrownPlatte River Equity

Mark BrownPlatte River Equity

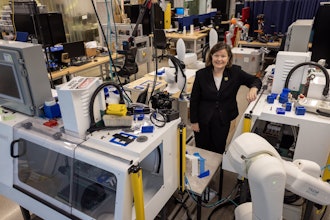

The second technology trend we are focused on for distributors is warehouse automation. This includes automated storage and retrieval systems, automated guided vehicles and robotics for picking and packing. But it also extends to warehouse software systems and technologies that automate inventory management and order fulfillment. These systems can drive increased efficiency, safety and customer satisfaction. We believe the distributors that invest in these types of technologies will be the winners in the marketplace going forward.

How big a role will automation and optimization systems play, particularly in pricing and marketing?

The biggest challenge we see across our portfolio and with other distributors we talk to is around attracting and retaining talent. So, the goal of automation and optimization investments we are making is to help our key employees become more efficient and productive by taking lower value-added tasks off their plates while providing paths to drive higher wages.

Specific to the question, pricing optimization and marketing automation are two key areas that we view as table stakes for any high performing distributor. We tend to partner with great consultants that help our companies implement proprietary systems. The pricing optimization systems have helped us drive smarter and faster decisions by leveraging the enormous amount of available data. AI will only add to these capabilities. On the marketing automation side, we are already seeing the benefits of identifying better qualified leads that give our sales forces a running start on building a higher probability sales funnel.

What are you seeing in e-commerce initiatives, both today and moving forward, from the distribution sector?

At first, we try to apply the lessons, technologies and tricks of the trade that the world class e-commerce retailers have employed over the past decade. We find that most of the distribution sector is still well behind on everything from dynamic pricing, increasing cart size, inventory availability and fulfillment. Once a company has established a core e-commerce capability, the goal is to find ways to develop more “sticky” relationships with our customers. Customer specific landing pages or private portals have been increasingly important to our distribution businesses. From there we are seeing distributors invest more into punch-out catalogs and becoming data repositories such that customers have real switching costs to move away from a particular distributor.

However, we know that the value of a great distributor is the connectivity they have with the customer. While e-commerce initiatives are wonderful, we continue to view them as one part of an integrated set of services and value-add capabilities for our customers.

Why will an ERP system be important, and what should distributors be looking for when evaluating them?

Peter CalamariPlatte River Equity

Peter CalamariPlatte River Equity

When evaluating a potential ERP system, businesses should consider any industry-specific requirements, its ability to integrate with other key systems (CRM, e-comm, IoT devices, etc.) and its ability to scale with the projected growth of the company. Ultimately, as an industrial distribution business, you will likely care the most about inventory management, warehouse management and supply chain optimization features. Some ERPs provide this functionality native to the application, while others partner with specialists to deliver the functionality. It is important to be clear about whose technology is doing what, and your comfort level with multiple integrations if the features you need aren’t native to the ERP itself.

How have some of the distributors Platte River has partnered with addressed these trends, and how are they making sure they’re on the right track?

We have given a couple of examples of how some of our distribution businesses have addressed these trends. It starts with our obligation as partners with investments in several distributors to share best practices across our companies. We also continue to learn new things each day evaluating investments in dozens of distributors in any given year. If the AI pilot programs we discussed end up working, then it is something we will look to have other businesses adopt. We also have dedicated operations professionals on our team that help ensure each distributor has access to the latest and greatest strategies and technologies. Lastly, we encourage our management partners to take part in industry trade associations, CEO roundtables and similar organizations so that they can contribute to the overall portfolio’s learning. Many of these technology trends have already had an impact on consumer, healthcare and, of course, technology sectors, so we are excited to see what the future holds for the distribution sector.