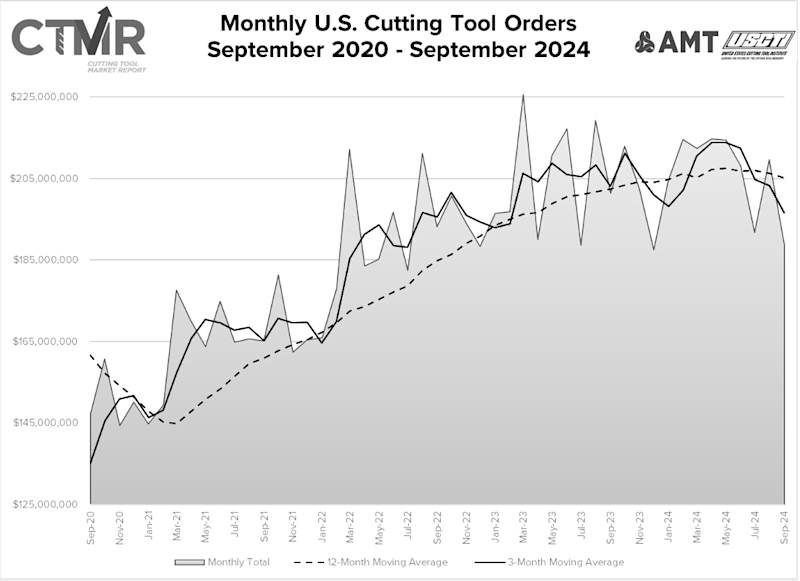

McLEAN, Va. — Shipments of cutting tools, measured by the Cutting Tool Market Report compiled in a collaboration between AMT – The Association For Manufacturing Technology and the U.S. Cutting Tool Institute, totaled $188.7 million in September 2024. Orders decreased 10% from August 2024 and were down 6.3% from September 2023.

Year-to-date shipments totaled $1.86 billion, up 0.7% from shipments made in the first nine months of 2023. The year-to-date growth rate has declined every month since April 2024.

“Despite the success and positive energy from IMTS for most exhibitors in Chicago, tooling continues to track at a slower pace,” noted Jack Burley, chairman of AMT’s Cutting Tool Product Group. “Staying consistent with the latest Purchasing Manager’s Index of less than 50, cutting tool consumption is still quite flat, indicating most shops are not running at full capacity. Inflation, interest rates, raw material costs, and pre-election uncertainty put many projects on hold. I do not think we will see any significant improvements until after the first quarter of 2025, when spindle utilization is expected to increase.”

Mark Killion, director of U.S. Industries at Oxford Economics, said: “September shipments were hurt by the machinists union strike at Boeing, eating into one of the largest sources of recent cutting tool demand. In addition, typical seasonal weakness was compounded by retrenchment in output of other customer sectors, such as business equipment, materials, and supplies for construction.”

The Cutting Tool Market Report is jointly compiled by AMT and USCTI, two trade associations representing the development, production, and distribution of cutting tool technology and products. It provides a monthly statement on U.S. manufacturers’ consumption of the primary consumable in the manufacturing process, the cutting tool. Analysis of cutting tool consumption is a leading indicator of both upturns and downturns in U.S. manufacturing activity, as it is a true measure of actual production levels.