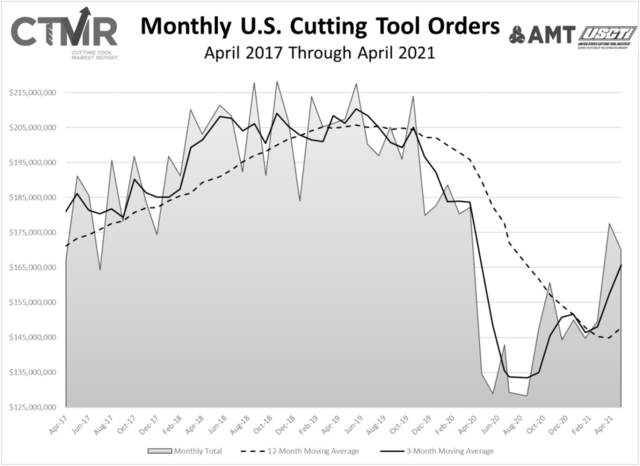

MCLEAN, VA — April 2021 U.S. cutting tool consumption totaled $170 million, according to the U.S. Cutting Tool Institute (USCTI) and the Association For Manufacturing Technology (AMT). This total, as reported by companies participating in the Cutting Tool Market Report collaboration, was down 4.3% from March's $177.6 million and up 26.3% when compared with the $134.6 million reported for April 2020. With a year-to-date total of $641.9 million, 2021 is down 6.4% when compared to April 2020.

These numbers and all data in this report are based on the totals reported by the companies participating in the CTMR program. The totals here represent the majority of the U.S. market for cutting tools.

According to Bret Tayne, president of USCTI, “While cutting tool industry sales contracted slightly from March to April, the general trend of recovery appears to be holding in spite of supply chain disruptions, the lack of incentive for the workforce to return, and other challenges our manufacturing customers are navigating.”

Costikyan Jarvis, president of Jarvis Cutting Tools, commented, “The April results show significant year-over-year increases, but that is benefiting from being compared to the first of the lockdown months. Unfortunately, the month-over-month results are not as strong. The April results suffered a 4.3% drop from March 2021 and indicate a pause in manufacturing’s return to pre-COVID levels.

“The macro trends are still strong. April’s PMI of 60.7 showed continued expansion, and the University of Michigan’s consumer confidence number of 88.3 remains high. All these point to a strong second half of 2021 and continued strength in 2022. Despite these positive trends, manufacturing is still facing immediate challenges. Commercial aerospace is still weak with no improvement on the near horizon. The chip shortage for automobiles is affecting demand, and finally, there are inflationary pressures being felt. The hiring of staff continues to be a challenge, and section 232 tariffs are still in place.

The Cutting Tool Market Report is jointly compiled by AMT and USCTI, two trade associations representing the development, production, and distribution of cutting tool technology and products. It provides a monthly statement on U.S. manufacturers’ consumption of the primary consumable in the manufacturing process – the cutting tool. Analysis of cutting tool consumption is a leading indicator of both upturns and downturns in U.S. manufacturing activity, as it is a true measure of actual production levels.

Historical data for the Cutting Tool Market Report is available dating back to January 2012. This collaboration of AMT and USCTI is the first step in the two associations working together to promote and support U.S.-based manufacturers of cutting tool technology.

The graph below includes the 12-month moving average for the durable goods shipments and cutting tool orders. These values are calculated by taking the average of the most recent 12 months and plotting them over time.