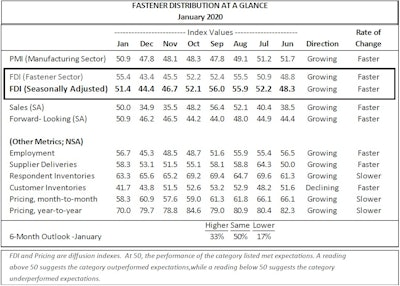

After a three-month slide culminating in the lowest reading in its nine-year history, FCH Sourcing Network's monthly Fastener Distributor Index (FDI) began 2020 on a high note, showing a considerable gain last month.

The FDI — operated by FCH in partnership with R.W. Baird — showed that January registered a seasonally-adjusted reading of 51.4, jumping 6.7 points from December and back into expansion territory. December's mark of 44.4 was the lowest reading since the FDI's inception in January 2012.

For the index, any reading above 50.0 indicates expansion, whereas anything below 50.0 indicates contraction.

The index had declined in three straight months following a recent high water mark of 56.0 in September 2019 before January's big jump. It essentially correlated with a slide in the Institute of Supply Management's monthly Manufacturing Purchasing Managers Index (PMI), which declined in five of the six months since June 2019 and was in contraction territory in November and December before rebounding with a 50.9 January reading.

The FDI's forward-looking-indicator (FLI) — which measures distributor respondents' expectations for future fastener market conditions — had a healthy 4.7-point gain in January to an expansion mark of 50.9. It was the FLI's first expansion reading since April 2019.

"Overall, fastener market conditions started off the year on a solid note in January, while respondents’ implied February forecasts are for continued moderate improvement given an FLI slightly above 50," noted R.W. Baird analyst David J. Manthey, CFA, about January's FDI numbers.

The FDI had been in expansion territory for 20 consecutive months before dipping to 48.3 this past June, recovering over the summer to a peak of 56.0 in September before declining each month since until January.

In January's FDI, the seasonally-adjusted sales index jumped 15.1 points to a break-even mark of 50.0. In other January metrics:

- Employment increased 12.4 points from December to 56.7;

- Supplier Deliveries increased 5.2 points from December to 58.3;

- Respondent Inventories dipped 2.3 points from December to 63.3;

- Customer Inventories dipped 2.1 points from December to 58.3;

- Month-to-Month pricing fell 2.6 points from December to 58.3; and

- Year-to-Year pricing fell 9.7 points from December to 70.0

The FDI's six-month outlook showed solid optimistic improvement in January:

- 33 percent of respondents now expect higher activity six months from now (compared to 25 percent in December)

- 50 percent of respondents expect similar activity six months from now (compared to 47 percent in Dec.)

- 17 percent of respondents expect lower activity six months from now (compared to 28 percent in Dec.)

Despite the overall solid improvement for the FDI's January figures, Manthey noted that respondent commentary still skewed negative overall. Manthey noted that while trends were on a balance better-than-expected for a majority of respondents, qualitive survey feedback still suggested a fairly muted demand environment.

See the full January FDI chart below:

Source: Baird, FCH Sourcing Network, Institute for Supply Management

Source: Baird, FCH Sourcing Network, Institute for Supply Management