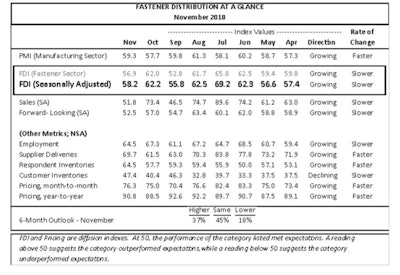

R.W. Baird and FCH Sourcing Network released their monthly Fastener Distributor Index (FDI) for November on Thursday, showing a slight decrease over October’s rating. Distributor commentary was mixed this month with favorable feedback on recent trade developments as well as some unease regarding future economic conditions.

The seasonally-adjusted November FDI showed a mark of 58.2, down slightly from October’s 62.2 reading. Selling conditions cooled off strong October trends, with the seasonally adjusted sales index coming in at 51.8 versus October’s 73.4.

The six-month outlook improved modestly month-over-month, although the Forward-Looking Indicator—aimed to provide a directional perspective on future expectations for fastener market condition —slipped to 52.5 over October’s 57.0 reading.

According to the FDI, 34 percent of respondents indicated sales were “better” relative to seasonal expectations versus October’s 69 percent.

Looking at other FDI metrics in November:

- Employment index decreased to 64.5 from 67.3 in October.

- Supplier Deliveries index increased to 69.7 from 61.5 in October.

- Month-to-Month Pricing index increased 76.3 from 75 in October.

- Year-to-Year Pricing index also increased to 90.8 over 88.5 in October.

- Respondent Inventories index increased to 64.5 from 57.7 in October.

- Customer Inventories index increased to 47.4 from 40.4 in October.

The FDI report gave the following analysis of commentary from survey respondents:

“The overall tone of qualitative commentary remained mixed this month, with favorable feedback on implications from recent trade developments offset by some unease regarding future economic conditions. For example, one respondent commented, “The new agreement with Mexico and Canada will bring confidence. This weekend’s talks with China, delay of increased tariffs, and China’s promise to buy more from US will inject some enthusiasm into economy.” Another participant said, “No immediate signs of slowing. November is traditionally lower than October, but still 30 percent above last year.” Others were less enthusiastic, saying “Some economic forecasts are predicting a slight downturn in 2019.” The six-month outlook, however, continues to point to stable to higher activity levels anticipated by fastener distributors over the next six months, with 37 percent of respondents expecting higher activity levels, 45 percent expecting similar activity, and just 18 percent expecting lower activity. For context, the percentage of respondents expecting higher activity this year has averaged 50 percent, while the percentage expecting lower activity has been 14 percent.”