This blog is part two in a three-part series by FORTE. To read the first part, please click here. For the second, click here.

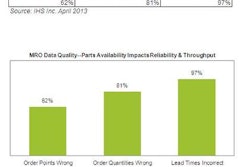

Part 1 of the planning phase - the Numbers - has been completed. Mountains of recent DC operating data have been mined, analyzed and digested. From this information we've gained a fairly accurate assessment of current fulfillment capabilities and capacities. We've identified system strengths and weaknesses. We've confirmed past performance versus KPI goals. And we've exploited this intelligence to project at least short-term volume, the impact of seasonal events, product mix, and the predominant channels through which these products will be sold and distributed. And finally, we've established ideal KPI goals for our new DC paradigm.

Simultaneously, a second team has been reviewing currently in-place corporate growth and operations strategies as well as the broad marketing strategies (i.e., the Four Ps of product, price, promotion and pipeline) to achieve this executive vision. When married with the data analyses described above, DC operators now have the necessary information to more clearly and accurately set a course for effective fulfillment strategies. They can begin to establish distribution capacity and space requirements, and determine the types and amount of MHE and supporting systems for each area of a retrofitted or new facility.

Kindly permit me an aside here to offer this advice: The consistent collection and analysis of operating data through an enhanced WCS can be a significant advantage when identifying trends and predicting scenarios to establish future DC network optimization strategies. The installation of advanced WCS software technology such as FORTE's Smart Warehouse Suite™ should be seriously considered in any DC expansion or new construction project.

Okay, now we're on to the Concept part of the planning phase, where we can dream big and let our minds wander. But in achieving the optimal facility, reality requires us to analyze each functional area independently of the others and subsequently, propose among one and four possible solutions for the problems identified in each. We proceed to evaluate all of the proposed solutions in terms of design, efficiency and, of course, cost versus affordability. And then we rank each solution vis-à-vis the KPI goals we've set during the Numbers analyses.

Next, we assemble the processes on paper through conceptual facilities layouts, only to quickly discover that the best solution for a specific functional area may not be ideal for the overall DC processing system. Looking at the sum of the parts is key to finding the best of the possible solutions. Here's an example: You've determined that "very narrow aisle storage" offers the densest storage in the least amount of square footage and appears to be the perfect solution in the reserve storage area. But when applied in a system model utilizing the most ideal picking solution, you realize this storage technique can't support required replenishment. When confronted with conflicting "best solutions", refer back to the KPI rankings for guidance and insight to make the necessary compromises and correct choices.

Other areas of consideration during the planning phase may include assessing the potential use of 3PL providers during construction or even longer term to address specific product and/or multi-channel marketing strategies. Perhaps consolidation of several facilities into one has become a strategically driven imperative. Either scenario requires transition planning, compliance program conformity, increased use of state-of-the-art MHE technologies and, potentially, network analysis.

The planning phase concludes with an evaluation of one to three conceptual facilities recommendations. Determining factors include budget limitations, personnel (particularly management) needs and equipment requirements. The key determinant is really a question: Which of these concepts - with all of the inevitable trade-offs and compromises - best achieves the KPIs that are driving the project?

This blog previously appeared as a blog on FORTE. To view the original, or for more information, please visit www.forte-industries.com.