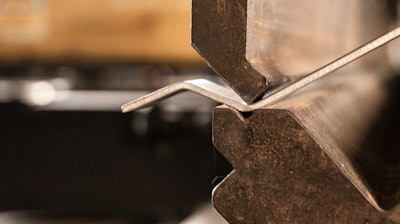

CLEVELAND, Ohio — Metalforming manufacturers’ outlook for economic activity continued to decline for the third consecutive month, according to the April 2025 Precision Metalforming Association Business Conditions Report.

Prepared monthly, PMA’s report provides an economic indicator for the next three months of manufacturing, sampling 99 metalforming companies in the United States and Canada.

PMA’s April report shows that only 16% of surveyed manufacturers anticipate an increase in economic activity in the next three months (down from 23% in March), 47% predict no change in activity (compared to 54% in March) and 37% expect a decrease in activity (up from 23% last month).

Metalformers also forecast a drop in incoming orders, with 26% of survey respondents anticipating a decline in orders in the next three months (compared to 24% in March), 47% predicting no change (compared to 40% last month) and 27% expecting an increase in orders (down from 36% reported in March).

However, current average daily shipping levels showed a modest rebound in April, with 44% reporting an increase in shipping levels (up from 35% in March), 41% reporting no change (compared to 40% last month) and 15% reporting a decrease in levels (down from 25% in March).

The survey also showed that only 4% of respondents had workers on short time or layoff in April (down from 12% in March), while 34% are currently expanding their workforce (the same percentage reported in February and March). Twelve percent of respondents reported an increase in lead times in April, compared to 14% in March.

“Metalformers are navigating continued economic uncertainty, with declining confidence in near-term conditions and softening order volumes,” said PMA President David Klotz. “Ongoing unpredictability surrounding U.S. trade policy is likely a major factor behind these forecasts—particularly the widening gap between U.S. steel prices and those in the rest of the world, which impacts a key input for our members. Some are seeing increased interest from customers looking to reshore production as a result of the tariffs, which is encouraging. However, proposals to eliminate critical programs like the federal Manufacturing Extension Partnership (MEP) are deeply concerning. If we want to strengthen domestic manufacturing and compete globally, we need continued support for programs that help small and medium-sized manufacturers modernize and innovate.”

Full report results are available at pma.org.