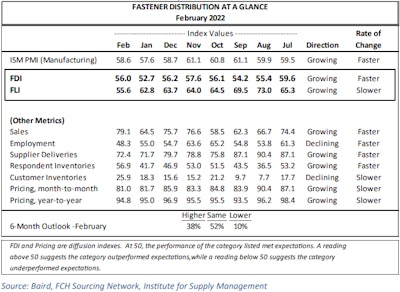

FCH Sourcing Network reported its Fastener Distributor Index (FDI) for the month of February on March 7, showing a considerable rebound one month after falling to a 14-month low in January, despite a continuing decline in near-term market optimism.

Last month's FDI showed a reading of 56.0, up 3.3 percentage points from January and snapping two straight months of decline. Any reading above 50.0 indicates market growth.

The FDI has been in expansion territory each month since September 2020, most recently peaking at 61.8 this past May and has held in the 50s since June 2021.

Meanwhile, the index's Forward-Looking-Indicator (FLI) — an average of distributor respondents' expectations for future fastener market conditions — had a sixth-straight decline. February's FLI of 55.6 was a significant 6.2-point decline from January and remains a stark decline from the readings above 70 seen in the spring and summer of 2021. It has been in the 60s since September 2021.

On the bright side, 38 percent of the FDI's fastener distributor survey respondents indicated they expect higher activity levels over the next six months compared to today, up from 33 percent in January. 52 percent expect the same activity level, while 10 percent expect lower activity. It's been a major reversal from the first half of 2021, when as many as 72 percent of respondents said they were expecting higher activity.

Overall, the index's latest figures suggest a notably better month for fastener distributors than January, while forecasted market conditions saw another decline in optimism.

"The recovery was broadly consistent with recovery seen in the ISM PMI and other macroeconomic data points as pandemic-related disruption eased," commented R.W. Baird analyst David Manthey, CFA, about the latest readings. "Respondent commentary suggests a continued supply and labor constrained market. Overall, we believe fastener market conditions were strong in February as demand remains robust, although fulfilling demand remains challenging."

Of the FDI’s seven factoring indices besides the FLI, four saw month-to-month increases, a contrast from five declining indices in January. Most notably, the volatile sales index jumped 14.6 points from January to a mark of 79.1. Supplier Deliveries edged up 0.7 points to 72.4; Respondent Deliveries jumped 15.2 points to 56.9; Customer Inventories increased 7.6 points to 25.9.

Declining in January were: Employment, down 6.7 points to 48.3; Month-to-Month Pricing, down 0.7 points to 81.0; and Year-to-Year Pricing, down 0.2 points to 94.8.

"This (FDI increase) was primarily driven by improvement in the sales index, as some respondents saw a release of previously backfilled orders caused by product availability/shipping constraints," Manthey said. "Pricing continues to increase as measured by the month-to-month and year-to-year indexes. Demand feedback was again very positive (booming incoming sales), but frustration with product availability and labor shortages continues to build. "

Manthey shared a sampling of anonymous member FDI member distributor commentary from the February survey:

- "Incoming sales are booming. Now if we could just get material from our vendors it would allow us to bring delivery estimates down to better meet the needs of our distributor partners!”

- “Demand still seems strong for now. Slower growth was expected by many economists [in 2H22}.”

- “Orders incoming are leveling off, but shipments are still strong as last year’s orders begin to ship. Product availability is still an issue. Hiring situation worsens with payrolls increasing and competition for hires heating up. Even Target is now paying $24/hour in some areas."

See the full February FDI table below: