FCH Sourcing Network reported its monthly Fastener Distributor Index (FDI) for the month of September on Oct. 7, showing a second straight month of deceleration amid numerous supply chain issues.

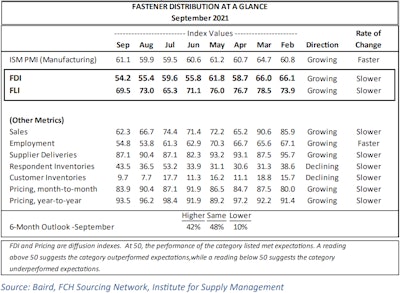

Last month's FDI showed a reading of 54.2 — still in expansion territory, but down 1.2 percentage points from August to the index's lowest mark since September 2020's 52.0.

Meanwhile, the index's Forward-Looking-Indicator (FLI) — an average of distributor respondents' expectations for future fastener market conditions — likewise fell 3.5 points to 69.5. That's still a strong mark, as anything over 50.0 indicates expansion, but a little weaker outlook than the low-to-mid 70's that the FLI had seen nearly every month since February of this year. The FLI has been at least in the 60s each month beginning with September 2020.

The latest figures suggest that fastener distributors, as a whole, have experienced a weaker summer after a strong first five months of the year, but still foresee better market conditions in the not-too-distant future.

The FDI has been in expansion territory each month since September 2020.

For context, the FDI bottomed out at 40.0 in April 2020 amid the worst of the pandemic's business impacts on fastener suppliers. It returned to expansion territory (anything above 50.0) in September 2020 and has been in solid expansion territory since the start of this past Winter.

"Commentary continues to point to solid demand and results that would otherwise be stronger if not for supply chain constraints, such as stainless-steel raw material shortages, lengthy delivery times, and labor shortages," commented R.W. Baird analyst David J. Manthey, CFA, about the latest FDI readings. "The Forward-Looking Indicator (FLI) similarly moderated on a softer six-month outlook and a slight uptick in customer inventory levels but continues to signal growth is expected in the months ahead. Net, September market conditions again softened m/m amid intense supply chain challenges."

Of the FDI’s seven factoring indices besides the FLI, four saw month-to-month declines. Sales fell 4.4 points from August to 62.3 in September; Supplier Deliveries fell 3.3 points to 87.1; Month-to-Month Pricing fell 6.5 points to 83.9; and Year-to-Year Pricing fell 2.7 points to 93.5. As for gains, Employment improved 1.0 points to 54.8; Respondent Inventories jumped 7.0 points to 43.5; and Customer Inventories improved 2.0 points to 9.7.

Manthey noted that FDI September survey commentary continued to focus on key themes of supply chain havoc and labor shortages.

Here’s a sample of anonymous distributor comments:

- “In my 45 years, I have never seen the supply chain this screwed up and pricing this out of control.”

- “Wecould do more if we had products coming in....right now if we are finding parts, we are buying it just to have it. UGH.”

- “Stainless steel raw material continues to be an issue; shortages and very long deliveries are hampering production. Also staffing shortages continue to slow and hamper production as positions remain unfilled for lack of candidates.”

- “We are having issues finding good outside sales, inside sales and warehouse help to fill open positions. Even though sales slowed just a bit in September we remain bullish on the near future. China shutdowns are coming and therefore we can assume the shortages will continue through 2022Q3.”

- “Demand is strong but supply chain issues could cause actual orders to soften.“

See the full September FDI table below: