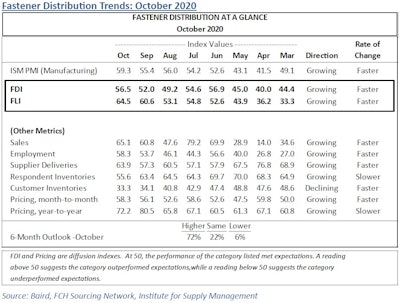

Following solid growth in the November manufacturing PMI, FCH Sourcing Network's monthly Fastener Distributor Index (FDI) showed a considerable jump in October, including increased optimism in the fastener market's near-term outlook.

The FDI — a monthly survey of North American fastener distributors, operated by FCH in partnership with R.W. Baird — showed a seasonally-adjusted October reading of 56.5, up 4.5 percentage points. That figure recently topped out at 56.9 in June before falling into the negative at 49.2 in August, but has rebounded since.

For the index, anything above 50.0 indicates expansion and anything below 50.0 indicates contraction. Thus, October's sizable increase was a solid one-month improvement and shows that the fastener distribution market grew at a faster pace than in September.

ID managing editor Mike Hockett recently joined FCH monthly Fully Threaded Radio podcast to discuss our 2020 Big 50 List in the show's leadoff segment. Check it out here.

The biggest driver of the FDI's October gain was its sales index, which has seen major volatility throughout the COVID-19 pandemic. After plummeting 31.6 points from July to August, the sales index had a 13.2-point rebound in September and then another 4.3-point gain in October to a mark of 65.1.

Here's how the FDI's other metrics progressed in October compared to September:

- Employment gained 4.6 points to 58.3

- Supplier Deliveries gained 6.6 points to 63.9

- Respondent Inventories fell 7.8 points to 55.6

- Customer Inventories fell 0.8 points to 33.3

- Month-to-Month Pricing gained 2.2 points to 58.3

- Year-to-Year Pricing fell 8.3 points to 72.2

The FDI's forward-looking indicator (FLI) — which measures distributor respondents' expectations for future fastener market conditions — set a new year-high in September, and rose even higher in October to mark of 64.5, indicating an even rosier market outlook. The FLI has surged 11.4 points since August and is now at its highest since January 2018.

"We view this breakout as a positive sign going forward, as low customer inventories, coupled with a continued slightly more optimistic tone around hiring, could bode well for near-term prospects," commented R.W. Baird analyst David Manthey, CFA, regarding the October figures. "Net, we believe the FDI should see expansionary readings in the near term, implying additional m/m improvement in market conditions ahead even as trends on a y/y basis for many respondents may remain down."

Looking at expected activity levels over the next six months, sentiment continued tp strengthen in October:

- Only 6 percent of respondents expect lower activity over the next six months, compared to 15 percent in September and 24 percent in August.

- 72 percent expect higher activity, compared to 61 percent in September and 53 percent in August

- 22 percent expect activity to remain the same, compared to 24 percent in September and August.

See the full FDI October chart below: