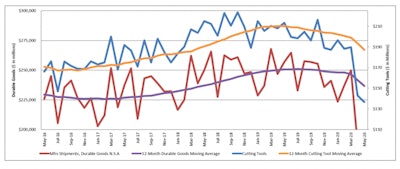

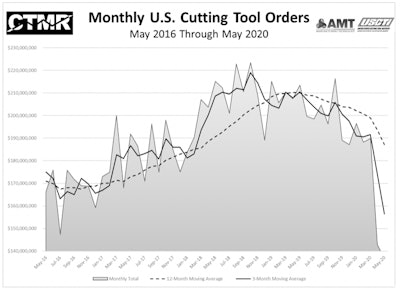

May 2020 U.S. cutting tool consumption totaled $136.6 million, according to the U.S. Cutting Tool Institute (USCTI) and the Association For Manufacturing Technology (AMT). This total, as reported by companies participating in the Cutting Tool Market Report collaboration, was down 4.4 percent from April's $142.9 million and down 36 percent when compared with the $213.4 million reported for May 2019. With a year-to-date total of $854.1 million, 2020 is down 18.8 percent when compared with May 2019.

These numbers and all data in this report are based on the totals reported by the companies participating in the CTMR program. The totals here represent the majority of the U.S. market for cutting tools.

"The cutting tool industry is doing its best to survive the effects of the forced pandemic recession, that is resulting in a significant decline in shipments," said Brad Lawton, chairman of AMT's Cutting Tool product group. "The questions are, when will we see recovery, in the third quarter or after the first week of November? And will we return to the sales volumes experienced in 2018 and 2019? Whatever are the answers, the facts are that the financial effects will be with the industry for an extended period."

“The cutting tool market in May continued to shrink from April but at a much slower pace. We are now starting to see some market segments begin to stabilize and those segments should start to recover slowly in the months ahead,” comment Phil Kurtz, vice president of business development of Dormer Pramet. He then stated, “It is very possible April and May will represent the bottom of the cycle, but considering the volatility of the current market only time will tell.”

The Cutting Tool Market Report is jointly compiled by AMT and USCTI, two trade associations representing the development, production, and distribution of cutting tool technology and products. It provides a monthly statement on U.S. manufacturers’ consumption of the primary consumable in the manufacturing process – the cutting tool. Analysis of cutting tool consumption is a leading indicator of both upturns and downturns in U.S. manufacturing activity, as it is a true measure of actual production levels.

Historical data for the Cutting Tool Market Report is available dating back to January 2012. This collaboration of AMT and USCTI is the first step in the two associations working together to promote and support U.S.-based manufacturers of cutting tool technology.

The graph below includes the 12-month moving average for the durable goods shipments and cutting tool orders. These values are calculated by taking the average of the most recent 12 months and plotting them over time.