Manufacturer monies that support distributor go-to-market activities are nothing new. Co-op, marketing development (MDF) funds, and volume rebates have been around for decades. In the last ten or so years, market-specific pricing funds called special pricing allowances (SPAs) have been added to the mix. These funds are used by distributors for a variety of activities related to increasing vendor sales. The funds can be used to offset operating expenses for marketing events (co-op and MDF) or they can be used to answer a competitive price (SPA). What’s new regarding these funds is their growth and increased usage in distribution markets. In the last five years, we find these funds have become increasingly important to distributor sales growth and profitability to where, today, nearly 80 percent of distributor executives expect these funds to stay at the same rate of sales or grow faster than sales.

Understanding Fund Growth

The demand for vendor funds is a confluence of factors including increase in online suppliers, fading of the Robinson-Patman legislation, and entry of new, more competitive online channels. These factors can be seen in Exhibit I.

As online technology becomes more pervasive, the customer has more choices from online suppliers to benchmark price and availability. The 60/60 rule says that sixty percent of prospective buyers have reviewed viable sources online and they have sixty percent more suppliers than they did five years ago. As the number of competitive suppliers increases so does competitive pressure back through the channel to the manufacturer for help to secure the sale. In a real sense channels are being compressed where the time to secure price and availability and issue the purchase order is much shorter than it was before online commerce. This time differential from realized need to purchase will fall further as online commerce becomes the dominant platform for transaction of commodities which average sixty percent of all distributor goods purchased. Today e-commerce, in B2B markets, represents approximately fifteen percent of demand and will increase to twenty-five percent by 2025 which means that there will be more of a need for vendor funds, especially non-standard pricing, for the future.

The decline in the power and usage of Robinson-Patman legislation is also a contributing factor for the rise in vendor programs. The legislation emerged in the Depression Era and legislated pricing parity, on a proportional basis, for the same goods to different suppliers. The legislation was, in most respects, adhered to as it wielded treble damages. During the 1990s and early 2000s, as Pac-Rim and Asian goods began to flood North American markets, manufacturers began using regional pricing to combat their growth. The prices of North American manufacturers were a response to a specific event where a foreign competitor was making inroads. Robinson-Patman legislation allowed for a price-matching defense, however, the onslaught of foreign private label brands was significant and manufactures decreased prices in large geographies for competitive events. A series of cases, from distributors challenging widespread pricing decreases from North American manufacturers, made it to the courts and used Robinson-Patman defenses. Many of these failed to prove harm and a slow decline began in the power of the legislation to where, today, it is much less used although it is still on the books.

Finally, the increase in vendor programs is driven by the increase in online channels. In a recent review of the Plumbing, Heating, Cooling, Piping vertical, we counted five new online channels that had emerged in the past ten-fifteen years. Before this, there were three primary channels in the sector. The addition of new types of channel intermediaries drives efficiencies to the end user. Manufacturers marketing through traditional channels are increasingly solicited for vendor funds to fight these new online competitors.

The upshot of e-commerce, decline in pricing legislation, and new online channels means that vendor funds are becoming increasingly important to traditional full-service distribution. Hence, the increase in these funds is assured. However, our work and research find that most distributors are poorly prepared to manage these funds outside of a tactical approach and new systems and a greater understanding of the managerial requirements of these funds needs exploration, definition, and documentation.

Funds Disparity, Complexity, and New Tools

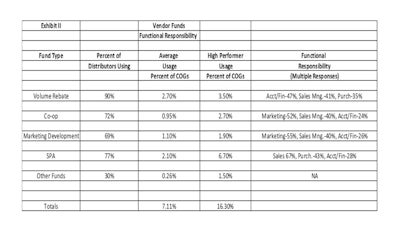

Most distributors have used vendor funds for decades, however, we find that many have a less than adequate understanding of the return on these expenditures, generating funds, and maximizing their usage. In our 2018 research for B2B distributors on five fund types (Co-op, MDF, SPAs, Volume Rebates and Miscellaneous funds) we found significant differences in fund usage and management control of expenditures.

In Exhibit II, we list fund types, usage by high performing distributors and average distributors, and which functional area controls which fund type. From the Exhibit, we find that the four most common fund types (Co-op, MDF, Volume Rebates, and SPAs) are used by three quarters of all distributors. Additionally, we measured fund usage as a percent of annual cost of goods (COGs) and found that top performing distributors (16 percent of firms) used total funds at a rate of 16.3 percent of COGs compared to average distributors who used funds at a rate of 7.1 percent of COGs. To give this difference perspective, if we make the generalization that funds are used for market/sales growth and add a 25 percent margin to top versus average performers, we find: 22 percent of sales related to funds for top performers and 10 percent of sales related to funds for average performers. Additionally, when we reviewed the functional area(s) that controlled the type of fund, we found significant differences. For instance, in SPAs, the primary control is in Sales at 67 percent whereas for Volume Rebates the primary control is in Accouting/Finance at 47 percent. The upshot is there is a significant disparity in fund usage among wholesalers and differences, by fund type, in the functions that control and manage funds.

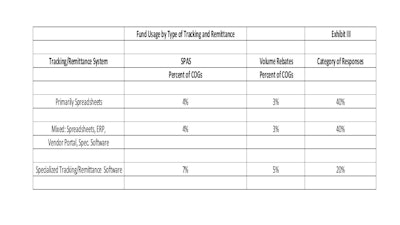

Given that most fund usage is event specific, the amount of transactions for, tracking, and securing fund payment is significant. We turned our attention and research to the way in which distributors managed fund monies and found a surprising outcome. In Exhibit III, we measured the type of tracking and remittance system(s) used by distributors for Volume Rebates and SPAs, the two most popular fund types. We measured systems that used primarily spreadsheets, mixed systems of spreadsheets, ERP, vendor portals, etc. and specialized software for funds tracking and management. The results were conclusive in that specialized software gave distributors 71 percent greater usage of funds (12 percent of COGS vs. 7 percent of COGs) than spreadsheet based or mixed methods. The software advantage for fund performance was greater than any other factor for funds performance. Yet, only 20 percent of distributors use software specific for vendor funds.

The disparity in fund performance, their increasing volume and complexity, and the use of software specific to fund management begs for specialization in this area of wholesale distribution. We end this blog with analysis of fund management process and recommendations on a new managerial discipline for wholesalers.

Fund Process, Software, and Vendor Funds Manager

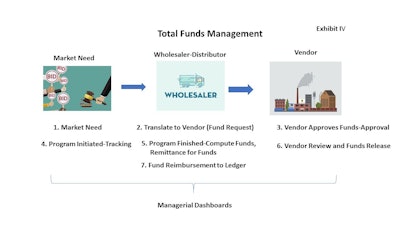

To understand the advantage of software in funds usage, one must first understand the high-level process of what happens to funds as they are requested and used. We introduce Exhibit IV as a pictorial view on funds management.

From the Exhibit, there are seven distinct processes to funds management starting with: 1) Market Need, and moving to 2) Translating the need for funds to the vendor, to 3) Vendor Approval (or rejection) of funds request, to 4) Initiate program and track progress, to 5) Finish program-funds computation and remittance for monies to vendor, to 6) Vendor review and payment release, to 7) Posting funds to ledger. The process is complex and requires significant follow up and review. Since funds are growing and can represent thousands or hundreds of thousands of transactions in a years’ time, manual processes are not sufficient to track the detail and maximize fund usage. Additionally, there is a real need for managerial dashboards by fund type to help manage funds to drive the ROI for expenditures. Since funds can represent significant competitive advantage in sales growth and market share, we recommend the appointment of a Vendor Funds Manager.

The Vendor Funds Manager is a position that, for all intents and purposes, doesn’t exist in wholesale distribution. Given the growing importance of funds, their newness, and their ability to confer market advantage it is advisable to appoint the position and make its power, review, and benchmarking significant. Most vendor funds are managed by a variety of departments and managers depending on the fund type. Hence, position would need cross-functional responsibility and authority. It is important for those designing the position that authority is given for funds’ usage to be balanced between the using positions and the Vendor Funds Manager. For instance, a balance should be struck between the Funds Manager and Sales Management when using SPAs. Additionally, the candidate should have solid experience with vendors, marketing program design, selling interactions, and pricing strategy. For the first several years, it makes sense to have the position report to executive management to drive progress and iron out impediments. To support the funds management position, there needs to be supporting software. Our research finds that without supporting software, funds maximization is not probable.

Funds software is relegated to a handful of vendors at present. Some software measures internal tracking only while other software completes the entirety of the process with all funds. We often get push-back from mid-market distributors that their co-operatives track and remit vendor funds. Our research says different, however, in that co-operatives track vendor rebates (back door funds) which are based on purchases but seldom track front door funds such as co-op, MDF, and SPAs that require market knowledge. Cooperative distributors have less than 50 percent of their funds from their cooperatives and the rest from individual negotiation with vendors hence their need for fund management software. Additionally, funds management software vendors are adding managerial dashboards to complement the basic functions of the funds management process.

Beginnings

The discipline of Vendor Funds Management is just beginning. Today, 16 percent of distributors maximize their funds and 20 percent of companies use software to drive fund usage. This will improve as more distributors realize the strategic importance of these funds to sales and profit growth. Appointment of a Vendor Funds Manager is strongly suggested along with review and purchase of software to support funds usage. Future subjects in funds management need definition and research including improving funds ROI, program design, vendor negotiation and partnership on funds usage, funds generation, and funds control. The discipline depends on the support of associations for research and leading distributors but the current environment of online commerce demands the building of systems, managers, and best practice for the discipline.

Scott Benfield is a consultant for B2B distributors and manufacturers. He is the author of six books on B2B channel issues and numerous research projects. He is based in Chicago and can be reached at Scott@BenfieldConsulting.com or (630) 428-9311.