TEMPE, AZ — Economic activity in the manufacturing sector expanded in June, and the overall economy grew for the 97th consecutive month, say the nation's supply executives in the latest Manufacturing ISM Report On Business.

The report was issued Monday by Timothy R. Fiore, CPSM, C.P.M., Chair of the Institute for Supply Management (ISM) Manufacturing Business Survey Committee.

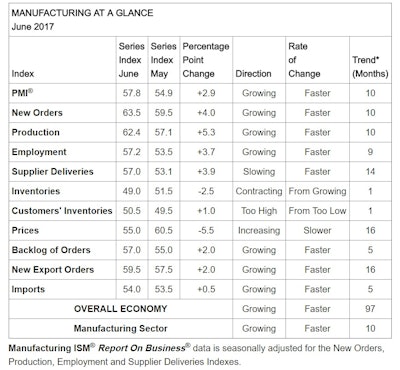

The June PMI registered 57.8 percent, an increase of 2.9 percentage points from the May reading of 54.9 percent.

- The New Orders Index registered 63.5 percent, an increase of 4 percentage points from the May reading of 59.5 percent.

- The Production Index registered 62.4 percent, a 5.3 percentage point increase compared to the May reading of 57.1 percent.

- The Employment Index registered 57.2 percent, an increase of 3.7 percentage points from the May reading of 53.5 percent.

- The Supplier Deliveries index registered 57 percent, a 3.9 percentage point increase from the May reading of 53.1 percent.

- The Inventories Index registered 49 percent, a decrease of 2.5 percentage points from the May reading of 51.5 percent.

- The Prices Index registered 55 percent in June, a decrease of 5.5 percentage points from the May reading of 60.5 percent, indicating higher raw materials’ prices for the 16th consecutive month, but at a slower rate of increase in June compared with May.

Comments from the panel generally reflect expanding business conditions; with new orders, production, employment, backlog and exports all growing in June compared to May and with supplier deliveries and inventories struggling to keep up with the production pace.

Of the 18 manufacturing industries, 15 reported growth in June in the following order: Furniture & Related Products; Nonmetallic Mineral Products; Paper Products; Machinery; Electrical Equipment, Appliances & Components; Chemical Products; Transportation Equipment; Computer & Electronic Products; Food, Beverage & Tobacco Products; Plastics & Rubber Products; Printing & Related Support Activities; Fabricated Metal Products; Wood Products; Miscellaneous Manufacturing; and Petroleum & Coal Products. Three industries reported contraction in June compared to May: Apparel, Leather & Allied Products; Textile Mills; and Primary Metals.

| Last 13 Months | |

|---|---|

| Month | PMI |

| June 2017 | 57.8 |

| May 2017 | 54.9 |

| April 2017 | 54.8 |

| March 2017 | 57.2 |

| February 2017 | 57.7 |

| January 2017 | 56.0 |

| December 2016 | 54.5 |

| November 2016 | 53.5 |

| October 2016 | 52.0 |

| September 2016 | 51.7 |

| August 2016 | 49.4 |

| July 2016 | 52.3 |

| June 2016 | 52.8 |

| Most recent 12-months average | 56.8 |

WHAT RESPONDENTS ARE SAYING ...

- "Overall, business is strong. We are seeing price increases for packaging and handling materials as well as some MRO supplies" (Plastics & Rubber Products)

- "Overall, demand is up 5-7 percent and expected to continue through the end of the year, at least. " (Transportation Equipment)

- "Demand is picking up; meeting budget expectations." (Electrical Equipment, Appliances & Components)

- "Business is still very robust. Have continued to hire to match increased demand." (Computer & Electronic Products)

- "Business [is] steady; not great, but good and fairly solid." (Furniture & Related Products)

- "Business globally continues to show improvement." (Chemical Products)

- "Environmental regulations have strong effects on our business. We continue to watch for any changes as a result of the new administration." (Paper Products)

- "Dry weather helping demand." (Nonmetallic Mineral Products)

- "International business outside North America on the upswing." (Machinery)

- "Metal pricing continues to drag down our profit margins, but we are very busy quoting new business, so our customers have a good outlook on the rest of the year." (Fabricated Metal Products)

- "Business is strong both domestically and internationally. Supplier deliveries are quick domestically, international supply chain is slowing. We are in a hiring mode." (Food, Beverage & Tobacco Products)