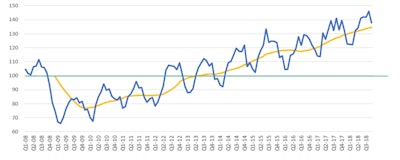

BlueTarp Financial—a credit management company for B2B suppliers—released its Q3 2018 Building Supply Index. The Q3 2018 12-month trailing average, which accounts for seasonality, hit an all-time high at 134.05, up from 132.46 in Q2 2018. The unadjusted view also remained high at 141.83.

To interpret the Index, values below 100 reflect recessionary or recovering performance. Values above 100 reflect healthy economic activity.

Macro-economic data are the main drivers for the elevated Index level. Consumer confidence reached 135.3, the highest in nearly two decades.

BlueTarp’s supplemental survey revealed 25 percent of contractors lack confidence in the future health of the US economy—a 64 percent increase from last quarter’s readout. Contractors expressed concern over the increasing tariffs, interest rates, and excessive borrowing.

“Despite what we’re seeing in consumer confidence, longer-term contractor optimism is showing signs of deterioration,” said Scott Simpson, CEO of BlueTarp. “It’ll be interesting to dig underneath what is changing and if that trend continues. As we’ve said repeatedly, both dealers and contractors should prepare for challenging days to come.”

The report represents trends from 120,000 pro customers and more than 2,000 building material suppliers across the United States. It also incorporates macro-economic drivers including: building permits, construction spend and consumer confidence as reported monthly by the Census Bureau and The Conference Board.