Full-service wholesale distribution — as defined by many sellers and many branches — is a significant sector of the North American (Durable Goods) GDP, with approximately $3.2 trillion worth of goods sold through more than 250,000 brick and mortar branches. The business model has been a staple of the economy for over a century and has proven resilient against structural changes, new competitors and vagaries of a market-based economy. Our research at Benfield Consulting and analysis, however, points to a sector that is vulnerable to New-Age online competitors and manufacturer direct sales. The financial make-up of the customer portfolio is a vulnerable spot or Achilles heel where competitors can cause debilitating operating loss by targeting as little as 15 percent of sales. Furthermore, our forecasts and research show this assault has begun and will increase substantially as new competitors and more manufacturers come online.

The Cost Burden of an Aging Business Model and New-Age Competitors

Full-service distribution is so named because of the service platform that offers customers a significant range of services including: numerous branch locations, personal sales attention, variations on packaging and delivery, customer asset management services, and a bevy of consulting and technical services. These services, however, come at a price; they are expensive. The common cost of operations to sales is on the order of 20 percent across some four dozen vertical sectors.

Making up these expenses are a number of services that, typically, fit into four broad categories including:

- Outside sales, inside sales, customer service, and sales management at 5 to 7 percent cost to sales

- Branch network at 2 to 4 percent cost to sales

- Accounting and credit financing at 1 to 3 percent of sales

- Various other services including extensive capacity buffers for specialized services and service variation 5 to 8 percent of sales

The basic structure of full-service distribution is a legacy from a different age when information in the supply chain was less reliable. For example, a non-stock item, back in the day, took several phone calls to verify the application, source, the product and inform the customer of price and availability. It was not unusual for this to take several days of waiting. A quoted material list, specific to a job, often took one to three or so days for turnaround and depending on the backlog. Today, with a reasonable search, the customer can find the information in a matter of minutes to an hour. To offer satisfactory service in a supply chain where information was limited, distributors compensated with brick and mortar locations, ample local inventory, and trained outside and inside sellers at the branch.

Exacerbating high service costs, sales compensation of which over 93 percent of plans have pay at risk, pays on incremental margin dollars over a prior time period. Sellers, to earn the sale in a maturing market, have grown their service promises to the customer. The problem is that these service promises are found in operating expenses and are not part of the compensation measure. Today, some 88 percent of wholesaler services are not fee-based and sellers regularly promise unique services or varying service provision including: differing intervals from standard promises, individual attention in product or application, specialized inventory, specialized pricing, varying credit terms etc. The result is that distributors must keep extra capacity in almost all levels of the firm in sellers and brick and mortar plus ramp up investment in specialized software to track service variation, ensure its satisfactory completion, and measure its profitability.

New Age competitors are firms developed for online commerce including examples such as Zoro Tool, Automation Direct and Amazon Business. These firms are characterized by state of the art technology, excellent search and delivery, few branches, few sellers and very competitive pricing. They have become prominent as distributor customers move online and select commodity or rote purchased products. Our research finds these firms can reduce price 7 to 12 percent on commodities and deliver 8 to 10 percent to the bottom line; a performance factor that is 3x the return of typical distributors. These firms are fast growth. Our estimate is that Zoro Tool is north of $500 million in sales and from $0 in sales in 2011. And Amazon Business grows at a 20 percent Monthly CAGR and some forecasts have it growing to $7 billion in 2018. These New Age firms leverage supply chain cost with online technology. The average wholesaler sells approximately $11 million per branch. Zoro Tool has five distribution centers for $500 million in estimated sales and Amazon is over $180B in sales with some 30 distribution centers.

The Commodity Skirmish Line and Customer Portfolio Risk

The current structural risk involves commodity products or items that the customer routinely orders and there are a handful of acceptable, competitive, substitutes. These products often have life spans of generations with minimal change and include pipe fittings, valves, cable, fasteners, etc. Our research finds some 40 to 70 percent of all distributor sales are commodities. The issue with commodities is that customers can easily forecast them and order them online with limited risk. In recent research, we asked some 130 distributor executives if their customers would increasingly order commodities online and want a reduced price. The agree/somewhat agree response was 83 percent versus a disagree/somewhat disagree response of 17 percent. The upshot is that commodities are easily ordered online, often at reduced prices, and customers are moving a significant amount of purchases online. A secondary question asked distributors if they had competitors who had scant sales forces but sold commodities online at a good price. The response was a 75 percent agree/somewhat agree versus 25 percent somewhat disagree/agree. The conclusion, for us, is that New Age competitors are valid competitors who specialize in selling commodities at a reduced price and aided by low-cost infrastructure.

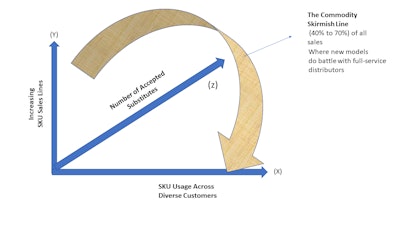

Exhibit I shows the commodity skirmish line denoted by three axes; Y, Z, and X representing various commodity sales measurements. When we measure commodities along these axes, we find the common range of commodity skus are 40 to 70 percent of total sales. Hence, a substantial portion of distributor SKUs can be ordered online with limited assistance and this poses a problem when reviewing commodity purchases of customers.

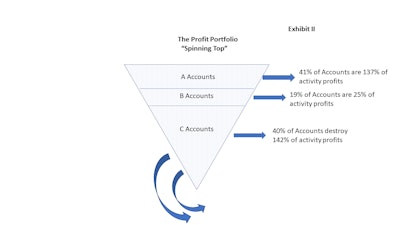

Customer portfolio risk begins with the view, from Activity Costing, that 40 percent of customers destroy 40 percent of operating profits ("C" Accounts) while 40 percent of customers generate 40 percent of activity profits ("A" Accounts) and 20 percent of customers cover their service costs with a little left over to contribute to operating profit ("B" Accounts.) This 40/20/40 configuration and operating contribution can be seen in Exhibit II. In the Exhibit, the shape is like a spinning top where the account make-up follows the configuration.

In general, these observations of portfolio activity profits closely represent those found by other activity costing methodologies. The upshot of the dynamics of the customer portfolio are similar to other mature box-in/box out industries in that:

- Firm profitability and operating income generation rests with the top 40 percent or "A" accounts

- Sellers promise services to all accounts along the spectrum but small orders, thin gross margins, credit issues and inordinate returns are found in "C" accounts

- "B" Accounts seldom change and can, at best, barely move the needle in overall operating income.

- Previous attempts to use Activity Based Management (ABM) rest on reshuffling the existing deck of service capacity but this takes considerable management oversight and upkeep and does not solve the core issue of excess service capacity misaligned to customers, supported/perpetuated by sales culture and sales compensation, and a Gordian knot of service complexity.

The solution to the misalignment is found in e-commerce which allows activity unprofitable customers to self-serve and the eventual paring down of sales capacity, brick and mortar stores, and simplifying the service platform. Unfortunately, these alignment/infrastructure solutions seem to be coming from New Age distributors and manufacturer direct efforts. These firms offer commodities, often 10 percent or so less in price, than existing full-service distribution firms and can, more easily than most wholesalers imagine, slow down or topple the spinning top and severely deplete operating profits.

The Plight of Average Wholesaler

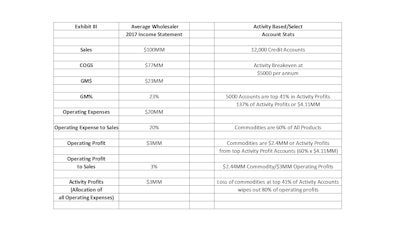

To understand the ability of New Age models to disrupt full-service distribution, we created the Income Statement of Average Wholesaler in Exhibit III:

In Exhibit III we see that Average Wholesaler sells $100 million at a 23 percent gross margin and 20 percent of sales as operating expenses for a 3 percent ROS. We assumed that the $3 million in operating profits is what is left after allocation of $20 million in expenses or representing 100 percent activity allocation of all operating expense. (Note:100 percent allocation of expenses is not our normal preference but is done here for ease of understanding and limited compromise to the overall results of the analysis.) Under the heading of Activity Based/Select Account Stats we find where Average has 12,000 credit accounts and the median annual sales, a threshold where accounts begin to turn activity profitable, is $5,000. The number of top activity accounts is 41 percent of 12,000 total accounts, or 5,000 in total and the operating profit generation of these accounts is 137 percent multiplied by the $3 million operating profit, or $4.11 percent. We are pegging commodity sales at 60 percent of total for Average which means that commodity sales for the top "A" activity accounts are $2.44 million or 60 percent of $4.11 million in activity income. When we compare the $2.44 million to the $3 million in operating income it is 80 percent of all operating income. And, using the $5,000 activity threshold for the 5,000 "A" accounts we have $25 million (5,000 x $5,000) in sales of which 60 percent or $15 million is commodities. The results of the analysis, research, and field work are surprising to most wholesalers with the findings that:

- 80 percent of operating income can be wiped out by targeting commodities of 40 percent of "A" accounts

- 15 percent of sales volume is all that separates the full-service wholesaler from financial duress

- The spinning top model is "top heavy" and metaphorically, to keep the top spinning, management is caught in an untenable situation where they lose "A" account commodities but have to make more service promises to "B" and "C" accounts to make-up for the lost sales. The result, as the rotations slow, is that the firm speeds up its downward spiral of decline and operating costs are consumed at an increasing rate greater than top line sales are generated.

Additionally, we find where New Age distributors follow a path of targeting commodity sales with low prices and give discounts for large orders. Large orders are a domain of the top "A" accounts and hence New Age models and manufacturer direct shipments can easily identify the "A" customers simply by scaling pricing to order size. Today, at 12 to 13 percent of overall sales online, distributors have some breathing room but forecasts are for 30 to 40 percent of sales to be online in ten years; a point at where few distributors will not feel significant pressure from new online competitors. Moreover and recently, we find full-service distributor requests in special pricing allowances, volume rebates, and market development funds to vendors are increasing as their business model comes under fire.

To address the situation our recommendations are for distributors to:

- Build out the online technology platform as soon as possible

- Align sellers and service to the accounts that can pay for them and away from accounts that can't or won't

- Conduct a service inventory and find which sellers are making the most unfunded service promises and correct the situation

- Move B and C accounts to e-commerce and reduce call frequency

- Look to reduce sellers and branches, in the long run, that don't support accounts who value the full-service platform

- Look to develop proprietary New Age offerings separate from the existing full-service platform

Scott Benfield

Scott BenfieldOur overall assessment is that New Age models of distribution and manufacturer direct policies will have a significant impact on the full-service distributor in the next decade. As e-commerce grows, online models take their efficiencies to market and wrest commodity sales away from full-service distributors with price. Targeting large order sizes with quantity bracket pricing ensures that "A" accounts will be targeted and a mere 15 percent of total sales loss at these accounts will ensure financial duress for the unprepared full-service distribution firm.

Scott Benfield is a consultant for manufacturers and distributors in the B2B sector on digital marketing, digital strategy, and digital transformation. He is a member and founder of Digital Channel Advisors, an association of consultants that helps mature b2b firms prepare for digital disruption. He has been quoted in Forbes and the Financial Times and can be reached at (630) 428-9311 or [email protected]